Banner Section

- Home

- Whitepapers

Whitepapers

Javelin Strategy & Research's reputation as an independent research and advisory firm is a discriminating factor our clients leverage to elevate their product, service or technology offerings. Our highly topical and customized whitepapers are designed to help boost our clients' brand recognition and value.

Listing View

Banks Take The Lead In Voice To Avoid Becoming The Dumb Pipes Of Personal Finance Digital Banking

- Whitepaper

- Date: December 12, 2016

- Author(s): Emmett Higdon

- Research Topic(s): Digital Strategy & Experience, Digital Banking

For many years, cable television was the sole provider of in-home entertainment for most Americans. With the arrival of streaming services such as Netflix and Hulu, consumers permanently shifted their viewing habits to the convenience of on-dema...

Banks Will Diversify Their Offerings And Keep Up With The Pace Of Innovation By Partnering With Strategic Fintech Players

- Whitepaper

- Date: December 12, 2016

- Author(s): Jacob Jegher

- Research Topic(s): Small Business, Digital Banking

Partnerships between banks and fintech are not new, but they have recently surfaced as a major industry trend. What’s different this time around is the surge in the number of competent start-ups and software vendors on the scene, and banks are h...

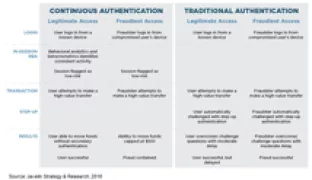

Continuous Authentication Becomes A Reality

- Whitepaper

- Date: December 12, 2016

- Research Topic(s): Fraud Management, Cybersecurity, Fraud & Security

The growth of digital financial technologies has placed dual pressures on security systems. Emerging digital channels have facilitated fraud like never before, but users are growing less tolerant of added friction. Digital interactions that rais...

Looking Beyond KBA

- Whitepaper

- Date: November 21, 2016

- Author(s): Emmett Higdon

- Research Topic(s): Digital Banking, Digital Strategy & Experience, Fraud & Security, Fraud Management, Mobile & Online Banking

This whitepaper, sponsored by Mitek, explores the challenge of identity verification in the digital account opening process, and how document scanning can improve on KBA driven processes.

Biometrics’ Growing Role at the Point of Sale

- Whitepaper

- Date: November 3, 2016

- Research Topic(s): Fraud & Security, Fraud Management

With mobile banking, person-to-person payments, and mobile wallets, mobile is rapidly becoming the go-to channel for financial activity. All of these activities feature instantaneous response with minimal friction. This expectation has strong im...

Giving Consumers Identity Control

- Whitepaper

- Date: November 2, 2016

- Author(s): Test Test, Kyle Marchini

- Research Topic(s): Fraud & Security, Fraud Management

This whitepaper, sponsored by Civic, investigates US-based consumers’ desire to have control over their own identities, and looks at the implications of the current lack of control they have over their own personally identifiable information (PI...

The Financial Impact of Fraud

- Whitepaper

- Date: October 25, 2016

- Author(s): Test Test

- Research Topic(s): Fraud Management, Fraud & Security

This whitepaper, sponsored by Vesta Corporation, analyzes the findings of a new independent study that examines how the cost of fraud has significantly increased post-EMV when compared to 2015, and the associated challenges impacting a merchant’...

Making ATM Transactions Safer, Faster and Fun

- Whitepaper

- Date: May 25, 2016

- Author(s): Emmett Higdon

- Research Topic(s): Mobile & Online Banking, Digital Banking

This white paper will examine what’s behind the growing popularity of this service, and how two innovative institutions, Salem Five and WSFS Bank, have integrated Cardless Cash into their digital banking strategies.

Mitigating Application Fraud from Synthetic Identities

- Whitepaper

- Date: April 20, 2016

- Author(s): Test Test

- Research Topic(s): Fraud Management, Fraud & Security

This whitepaper, sponsored by ID Analytics, explores the challenges that FIs and issuers face against a rising tide of application fraud and how the sharing of intelligence offers long-awaited hope in detecting the synthetic identities that make...

Beyond Simple and Safe

- Whitepaper

- Date: April 20, 2016

- Author(s): Beth Robertson, Mark Schwanhausser

- Research Topic(s): Mobile & Online Banking, Digital Banking

With the goal of gaining a closer understanding of the actions and attitudes of consumers toward Direct Deposit of payroll, NACHA commissioned JAVELIN to conduct market research looking at all segments of the U.S. population, as they relate to G...

Pagination

Open Positions