Beyond Simple and Safe

- Date:April 20, 2016

- Author(s):

- Beth Robertson

- Mark Schwanhausser

- Report Details: 31 pages, 6 graphics

- Research Topic(s):

- Mobile & Online Banking

- Digital Banking

- PAID CONTENT

Overview

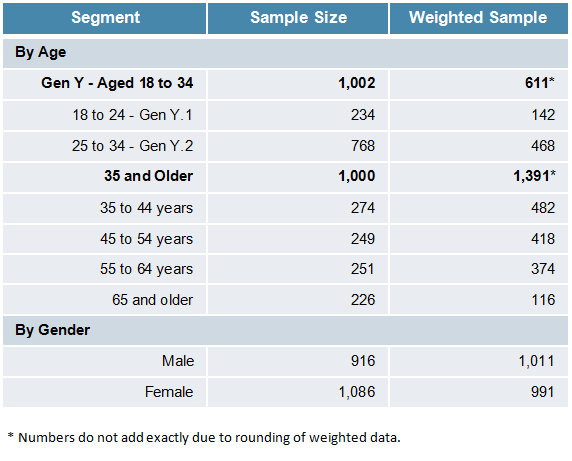

With the goal of gaining a closer understanding of the actions and attitudes of consumers toward Direct Deposit of payroll, NACHA commissioned JAVELIN to conduct market research looking at all segments of the U.S. population, as they relate to Gen Y — the group of consumers aged 18 to 34. NACHA, along with input from America Saves, a campaign managed by the nonprofit Consumer Federation of America, worked with JAVELIN to field a comprehensive online survey of 2,002 consumers in August 2015. The resulting sample was weighted to reflect the age and gender distribution of employed consumers in the general population.

JAVELIN independently produced the whitepaper and maintains independence in its data collection, findings, and analysis.

Sponsored by:

Methodology

Javelin Strategy & Research, a Greenwich Associates LLC company, conducted a 15-minute online survey in August 2015 among a sample of over 2,000 consumers specifically targeted to represent the Gen Y (aged 18 to 34) population and the segment of consumers aged 35 and older. Gen Y groups were substantively oversampled to provide rich insight into the segment and its subgroups. Overall, the sample has a margin of sampling error of ±2.2 percentage points at the 95% confidence level. Survey participants were required to be employed on either a full-time or part-time basis, providing them an opportunity to receive Direct Deposit of payroll from their employers. The resulting sample was weighted to reflect the age and gender distribution of employed consumers in the general population.

Survey Sample Composition

Book a Meeting with the Author

Related content

Growing Adoption, Low Satisfaction Raise Risks for Mobile Customer Service

Mobile banking has surged past online use, becoming the primary channel for everyday financial tasks. Yet as reliance grows, so do expectations for fast, intuitive support and mean...

Data Snapshot: Finances Are Shared, but Digital Banking Isn’t

Financial institutions, with digital banking experiences built largely for individuals, are missing the financial reality of most Americans. Consumers’ finances don’t exist in a va...

2026 Digital Banking Trends

This will be a year in which the industry’s attempts to add investing capabilities, boost digital sales, and simplify money movement will expose deep digital weaknesses and challen...

Make informed decisions in a digital financial world