U.S. Small Business Credit Card Forecast, 2017–2022: Healthy Market, Room for Improvement

- Date:March 14, 2018

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

Mercator Advisory Group’s latest research report, U.S. Small Business Credit Card Forecast, 2017–2022: Healthy Market, Room for Improvement, projects that small business card will approach $700 billion by 2022. The report suggests that an additional 50 percent of transactions now posted on consumer cards could instead run on small business payment cards if small business owners realize that the dedicated cards have features suitable for running a small business.

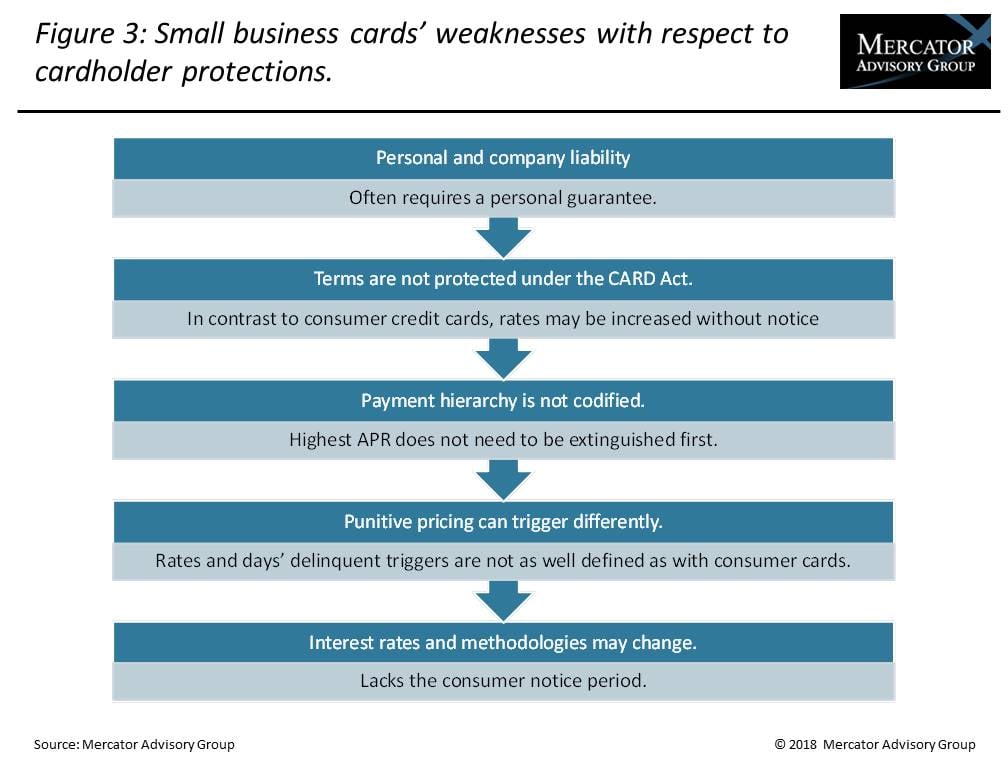

“Some small business owners prefer to use their personal credit cards for their business,” commented Brian Riley, Director, Credit Advisory Service, at Mercator Advisory Group, author of the research report. “There are some benefits to the consumer card, but when it comes to accounting for expenses and controlling usage it is hard to beat the current infrastructure,” Riley added. “Issuers might accelerate movement if they give small business owners the same protections afforded to consumers in the CARD Act.”

This document contains 20 pages and 9 exhibits.

Companies mentioned in this research note include: American Express, Bank of America, Bank of the West, BB&T, Capital One, Chase, Citi, Discover, FICO, Key Bank, Navy Federal Credit Union, PNC, MasterCard, Regions Bank, SunTrust, U.S. Bank, Visa, and Wells Fargo.

One of the exhibits included in this report:

- Estimated spend volume

- Shadow credit, small business spend posted to personal credit cards

- Detailed market view of co-brand and issuer small business cards

- Essential features of a small business card

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world