Overview

Boston, MA

September 2005

U.S. Private Label and Store Credit Card Market Update

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

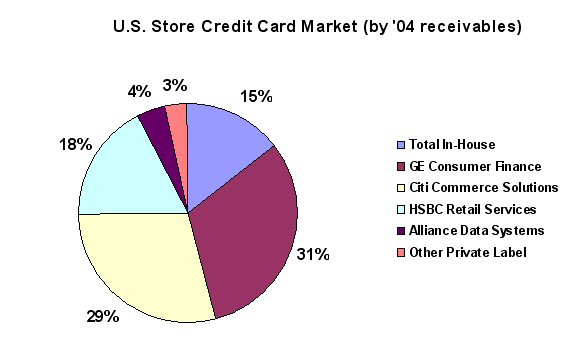

The U.S. store credit card market has changed dramatically, especially over the past few years. A large number of retailers got out of the credit card issuing business by selling their store credit card portfolios and outsourcing their card operations to private label credit card issuers. This resulted in a major shift in the ownership of U.S. store credit card receivables. As of year-end 2004, U.S. private label credit card issuers' share of the store credit card market receivables was 85% versus the 45% share in 1999.

The trend did not end in 2004. Most recently Federated and Bon-Ton stores announced that they have agreed to sell their store credit card portfolios. By the end of 2006, when the conversion of these portfolios are completed, private label credit card issuers will increase their market share to more than 92% (based on 2004 figures.

"Private label credit issuers continue to signal the market that they are willing to buy more store card portfolios as they become available", comments Evren Bayri, Director for Mercator Advisory Group's Credit Advisory Service. "This is good for growing through acquisitions but as a next step, private label issuers and retailers need to find ways to generate organic growth. Using an innovative approach to co-branding such as the Starbucks Duetto Card or the Wal-Mart Discover could be a solution."

This report provides an update on the U.S. store credit card market; it explains how the market has evolved into its current state, it looks at market trends and store credit card statistics. It also covers industry players and their current initiatives, and provides an analysis for the future direction of the industry.

The report contains 24 pages and 16 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

2026 Credit Card Risk: Happy Days are Here Again (For Top Issuers)

The year bodes well as 2026 approaches the end of the first quarter. Economic indicators are strong, the credit card market is growing at a healthy rate, and credit cards rem...

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Make informed decisions in a digital financial world