Overview

The U.S. faster and real-time payments market volume experiences an upsurge.

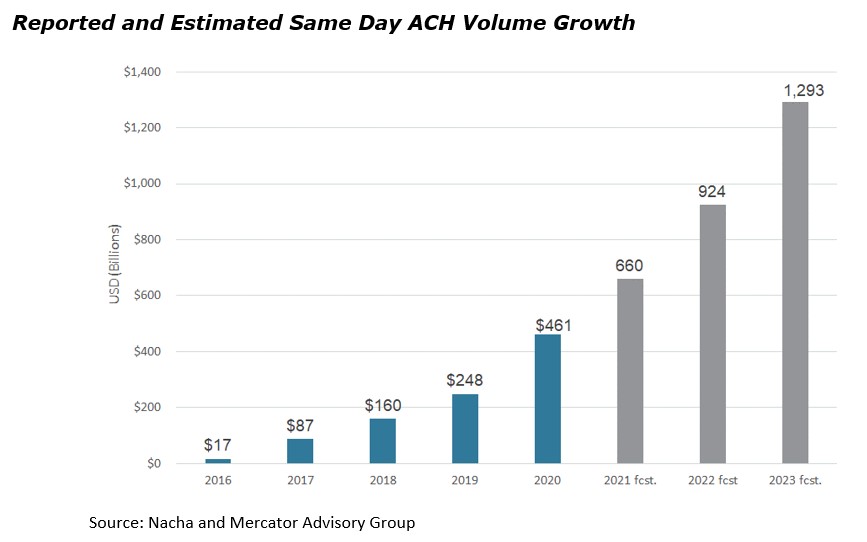

The pace of real-time and faster payments adoption accelerated in the U.S. during 2020 as explored in new research from Mercator Advisory group. Solutions such as debit push payments, The Clearing House RTP network, Same Day ACH, and Zelle all experienced strong double-digit and even triple-digit growth in certain use cases. Gains were in part due to the unique environment created by the global pandemic which values fast digital payment types, plus the simple fact that financial institutions and fintechs alike continued to integrate and launch new payment options for customers and members.

”More financial institutions completed technical integrations with faster and real-time networks, not only driving transactions from their customers and members for these products, but also beginning to drive internal efficiencies leveraging the new payment rails for account transfers, vendor payments, or payments from clients for loans and credit cards. Faster and real-time payments came to the rescue during the global pandemic, providing more convenient P2P transactions and opportunities including same day settlement for smaller retailers who appreciated receiving their merchant settlement more quickly,” comments Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group and author of the report.

This report has 16 pages and 6 exhibits.

Companies mentioned in this report include: Early Warning, FIS, Fiserv, Jack Henry, Mastercard, PayPal, Square, The Clearing House, Visa.

One of the exhibits included in this report:

Highlights of the report include:

- A view into the current state of progression for The Clearing House RTP system, Early Warning’s Zelle network, the global debit networks’ push payments and Same Day ACH

- A forecast for dollar volumes processed for each of the networks

- Discussion of some of the misnomers and myths circulating

- Current succeeding use cases

- Where the next wave of growth is likely to emerge

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world