The U.S. Commercial Card Market: A Growing Virtual Reality

- Date:September 14, 2016

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

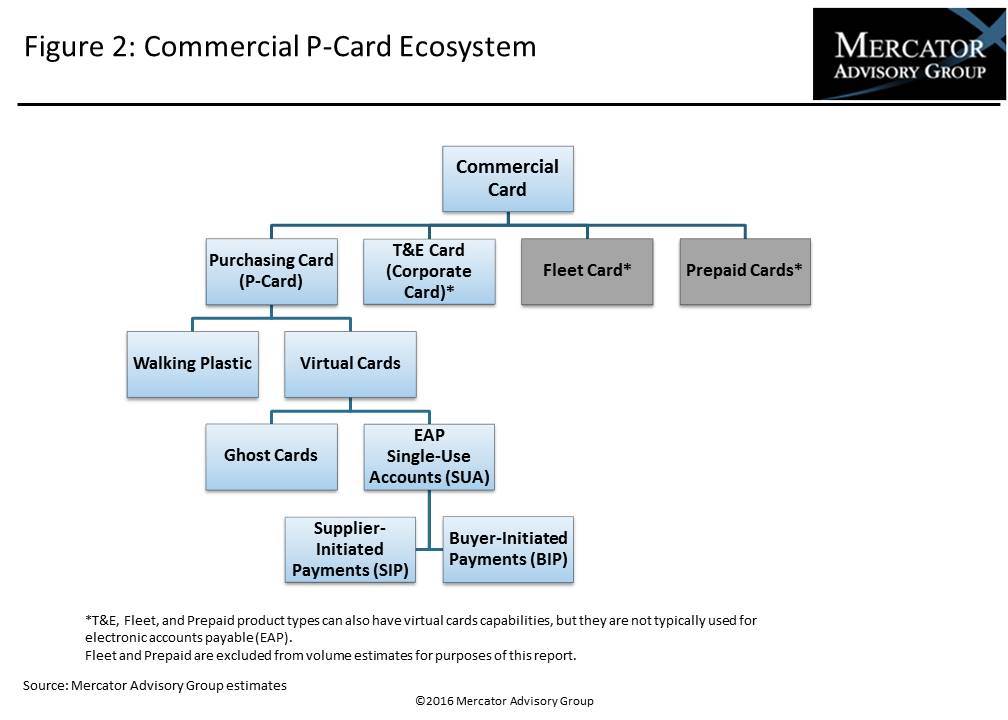

In a new research report, The U.S. Commercial Card Market: A Growing Virtual Reality Mercator Advisory Group reviews the corporate purchasing and virtual credit card landscape for the mid to large corporate market sectors. The report discusses how virtual card payments, led by single-use accounts (SUA), are driving the current growth trends.

"The increase in U.S. commercial card purchase volume in 2015 was largely driven by P-card-related spend, including virtual accounts in both reusable and single-use forms. Traditional commercial card accounts (walking plastics for both travel and procurement) continue to grow between 4% and 7% combined,” commented Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “That portion of the market is more heavily dependent on economic indicators like GDP. But double-digit growth in EAP has been the driving force behind the recent higher commercial card growth. Mercator Advisory Group expects that this trend will continue over the next four years”.

The research report is 20 pages long and contains 7 exhibits.

Companies mentioned in this report include AOC, Bora Payment Systems, Comdata, CSI Enterprises, Verient, and WEX.

One of the exhibits included in this report:

Highlights of the research report include:

- A review of the current factors contributing to the growth of business-to-business (B2B) payments overall and commercial cards specifically

- A detailed review of the products in the commercial cards space

- Growth projections for commercial credit card product types through 2019

- Detailed reviews of electronic accounts payable (EAP) and the factors behind surging single-use account (SUA) spend

- Network, issuer, and market sector views and perspective

- A discussion of the opportunities and potential threats in the U.S. commercial card industry

Book a Meeting with the Author

Related content

One Year On: Tariff Impacts on U.S. Imports and What They Mean for Treasury and Payments

The 2025 tariff regime triggered sharp, policy driven shifts in U.S. import patterns, with tariffs reliably pushing trade away from high duty lanes and toward lower duty or exempte...

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

Make informed decisions in a digital financial world