Overview

Consumers’ demands and expectations for bill pay created the shift towards digital interfaces and also an expectation around a choice of payments and greater transparency regarding payment status. Their expectations are often better met through biller solutions, not banking platforms. With improved technology for financial institutions, there is an opportunity to bring consumer bill payers back and provide enhanced convenience through a single, consolidated tool, as covered in a new report from Mercator Advisory Group titled U.S. Bill Pay Market: Can Financial Institutions Win Back Payers?

”More modern options for bank bill pay that include better notifications and payment choice will help to bring consumers back to financial institutions’ bill pay platforms. Bill pay is a critical component to securing consumers’ preferred financial institution status. But I don’t expect that consumers will return to their financial institution to pay bills at same level experienced 10 to 15 years ago. Consumers have created the habit of paying directly with billers and the way that consumers establish services today, including the rise of the subscription model, supports more direct-to-biller activity,” comments Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group and author of the report.

This report has 14 pages and 6 exhibits.

Companies mentioned in this report include: ACI, Early Warning, FIS, Fiserv, Mastercard, The Clearing House.

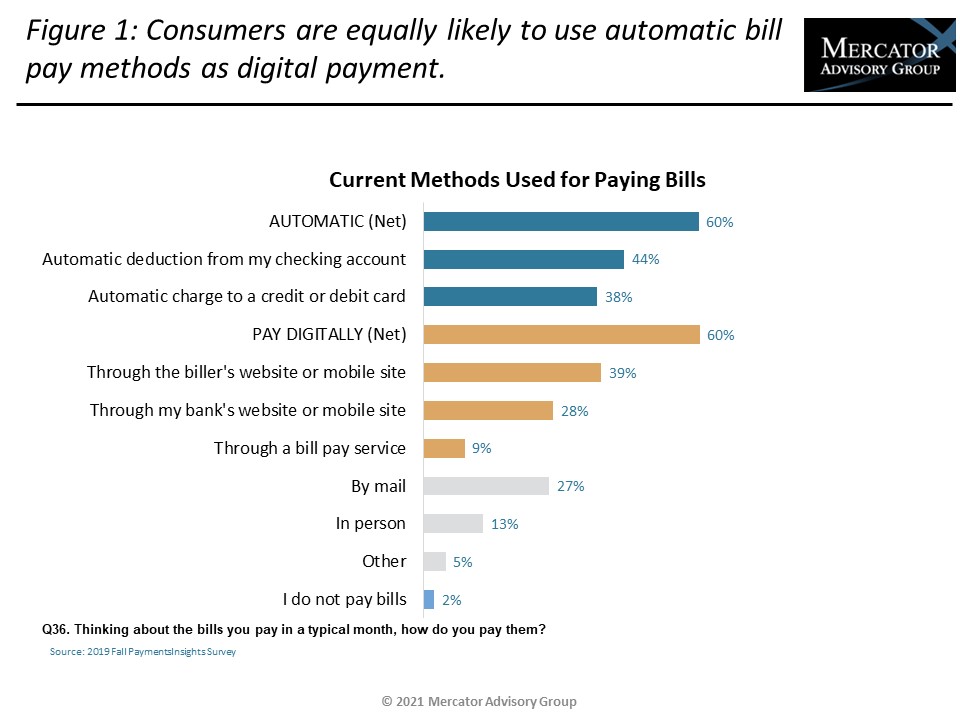

One of the exhibits included in this report:

Highlights of the report include:

- Review of the payment methods and channels that consumers are using today to pay bills

- Estimates and forecast for bill pay activity by paper, card and other electronic methods

- The impact of COVID-19 on bill pay

- Discussion of the gap between payments used to pay bills and the payment types consumers prefer

- Payment methods in the subscription based model

- Consolidation of fintech bill pay solution providers by processors

Book a Meeting with the Author

Related content

State of Debit 2026

Despite headwinds that include significant financial strain on consumers despite a broadly stable economy, debit remains resilient—especially among younger consumers and lower inco...

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Make informed decisions in a digital financial world