Overview

Boston, MA – January 21, 2014 – Debit cards, transactions, and volume are being challenged more than ever and face increasing pressure in 2014 from alternative payment products. Consumers are being enticed by lower prices, customized features, and value-added services. These trends, combined with the reduction in large card issuers’ income due to limits on debit card swipe fees by the Durbin Amendment to the Wall Street Reform and Consumer Protection Act, have forced large banks and credit unions to make critical decisions on whether to provide value-added services/rewards on debit cards and how to fund them. Smaller banks and credit unions are beginning to take advantage of the opportunity by offering new and enhanced debit rewards programs. Mercator Advisory Group’s latest report, Top 50 U.S. Retail Banks and Credit Unions’ Debit Rewards and Loyalty: 2013 Annual Review, provides an update of consumer debit trends, a look at merchant-funded discount networks (MFDNs), changes in debit rewards among smaller retail banks and credit unions, and what to expect in rewards in 2014.

A combination of the Durbin Amendment and the expected impact of the economic environment have led industry experts to believe that both large and small debit card issuers would be dropping debit rewards programs. But just the opposite is true. Only a few issuers have stopped their rewards programs. But the economic environment, regulatory changes, innovation have driven issuers to look for alternative ways to deliver these programs. They have responded in various by changing traditional points programs to merchant-funded discount programs, charging fees for these reward programs, and changing point valuations and earn and burn rates.

“Overall, issuers, particularly those regulated under the Durbin Amendment are moving away from traditional rewards-only programs that helped spur consumer debit card use over the last 10 years. Analytics and merchant-funded discount networks have made it possible to deliver a far more lucrative targeted rewards program for issuers today,” comments Ron Mazursky, Director, Debit Advisory Service at Mercator Advisory Group and author of the report.

This report has 20 pages, 5 exhibits, and 2 appendixes with reward program details.

Companies mentioned in this report include: Cartera Commerce, Truaxis (MasterCard), Affinity Solutions, Cardlytics, Edo Interactive, FreeMonee, Linkable Networks, Segmint, Rainbow Rewards, RewardsNOW, U.S. Bank (Elan Financial Services), Bank of America, PNC, FiServe, Randolph Brooks Federal Credit Union, Police and Fire Federal Credit Union, Fifth Third Bank, Dynamics Inc.

Members of Mercator Advisory Group’s Debit Advisory Service have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

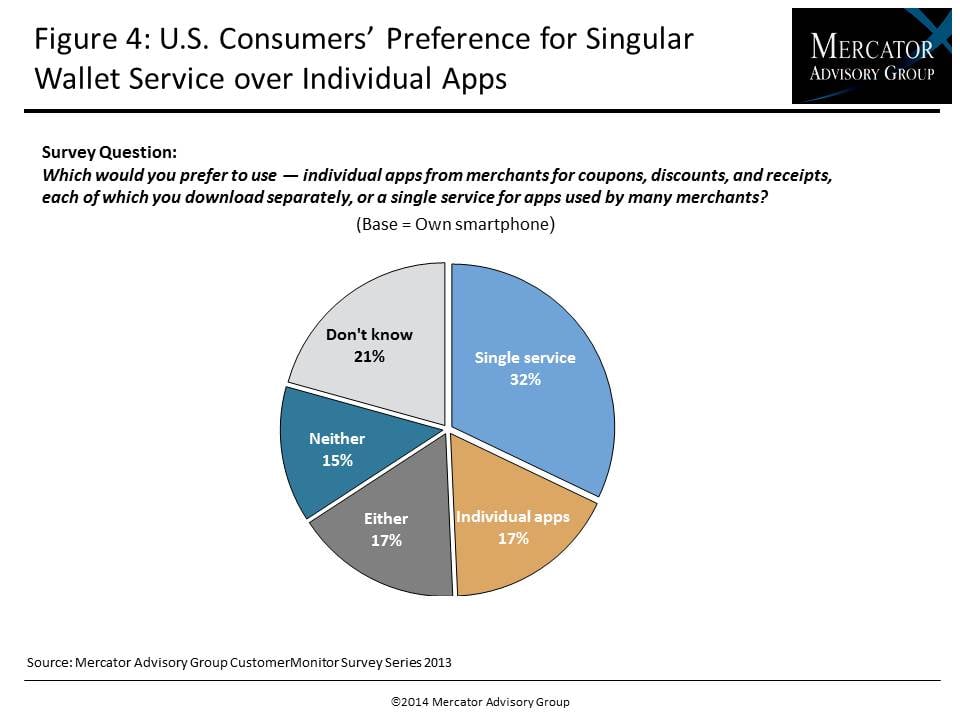

One of the exhibits included in this report:

Highlights of the report include:

- Understanding the evolving consumer trends related to debit cards

- A look at merchant-funded discount networks

- Small bank and credit unions’ advantage

- Notable changes in debit rewards for top 50 issuers between 2012 and 2013

- What to expect in rewards in 2014

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world