Overview

The Rise of the VARs: Merchant Attrition and Value-Added Technology's Impact on Account Retention

Research Examines Value-Added Technology

and Merchant Acquirer Account Attrition

Boston, MA - July 9, 2009 -- As merchant processing technology has evolved, and its variations and varieties have become more diverse, an exceedingly large number of entities have gained a very significant footprint within the merchant card services space while participating only in auxiliary capacities in the payments value chain.

These entities are known by several different monikers, all of which seem to acknowledge their ancillary nature: Third-Party Processors, Certified Vendors, Value-Added Resellers. While industry nomenclature keeps these entities at arm's length, the greater market, including the core "merchant side" payments value chain participants, is more than happy to depend upon them to provide solutions to merchants that the core has not traditionally had to offer. In effect, acquirers have willfully allowed themselves to be disintermediated by others delivering the value-add, while concentrating their main focus on delivering the commodity service.

Mercator Advisory Group's The Rise of the VARs: Merchant Attrition and Value-Added Technology's Impact on Account Retention examines the market dynamics surrounding merchant account attrition in the United States as they are revealed through government business statistics as well as processor and acquirer data. Discussion also focuses on payment solutions brought to market by VARs/TPPs and by merchant acquirers that are in direct competition with VARs' products, as well as some of the issues associated with that business model. We also explore ways in which VAR applications impact acquirer/merchant relationships from both the retention and attrition perspectives. Finally, we address some of the lingering compliance concerns with VAR solutions as more and more merchant payment volume passes through third-party systems every year.

"Merchant attrition could be effectively alleviated if acquirers offered value-added solutions above and beyond the commodity service to merchants they want to retain, actually delivering value, making the merchants want to stay put. In the context of merchant-initiated voluntary attrition, technology can, and should, play a leading role in merchant account retention, thereby potentially reducing the amount of natural churn in the marketplace," David Fish, Senior Analyst in Mercator Advisory Group's Credit Advisory Service and author of the report comments. "As more and more providers of value-added technology enter the merchant payment processing space, and as payment acquirers act more and more like VARs themselves, the industry faces yet another cycle of creative destruction. In one regard, the technology itself, upon which the industry has no choice but to grow, is partially responsible for accelerating change within the industry as new business models it enables arise. On the other hand, shifting market dynamics feed back upon the technology, which has no choice but to evolve to accommodate those shifts."

Report Highlights Include:

- Value-Added Technology is changing the merchant services space and merchant acquirers are seeking ways of expanding their own value-added technology footprint.

- Value-Added Resellers have fueled the innovation that has spurred merchant processors and acquirers to pursue value-added technology.

- Much of the interest in value-added technology from acquirers has been in response to rising concern about merchant attrition and ways in which technology might facilitate greater retention.

- However, unless the acquirer/processor is also the technology provider, VAR systems, by virtue of their agnostic nature, have a tendency to make merchants more slippery.

- Security and operational compliance concerns also arise when value-added technology is thrown into the merchant mix, and deadlines for compliance with PA DSS are looming.

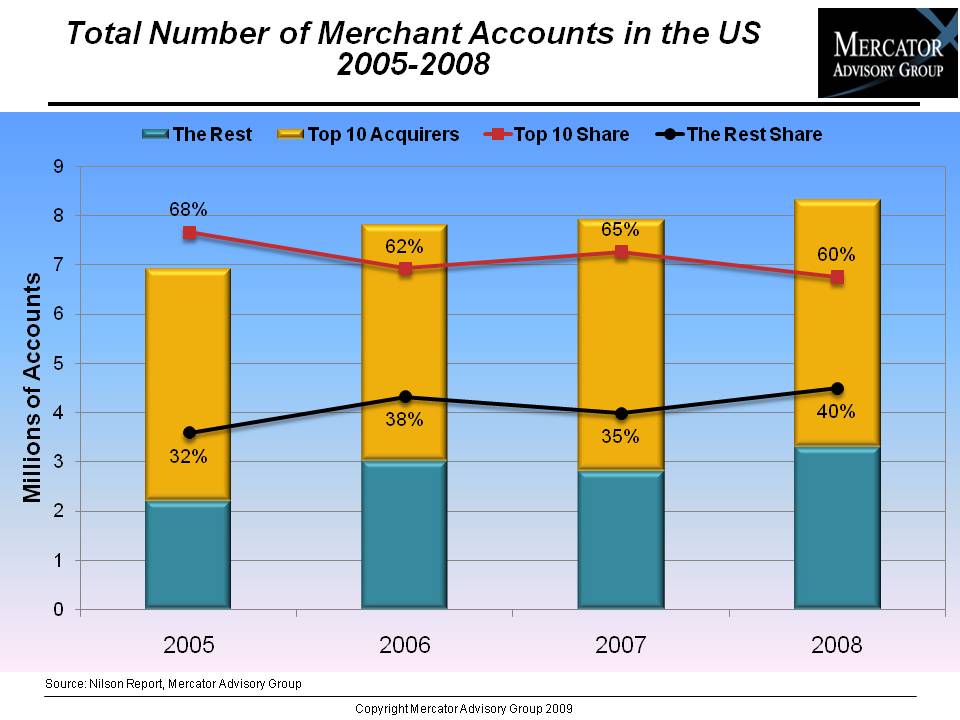

One of the 7 Exhibits included in this report:

This report contains 27 pages and 7 exhibits

Companies Mentioned in This Report: Apriva; Banc of America Merchant Services; Bank of America; Chase Paymentech; Citi Merchant Services; CyberSource (Authorize.net); Elavon; Fifth Third Processing; First Data; First National Merchant Solutions; Gilbarco; Global Payments (GPN); Heartland Payment Systems (HPY); Infonox, a TSYS company; Kohlberg, Kravis & Roberts (KKR); Litle & Co.; Main Street Softworks (Monetra); MasterCard; Merchant Link; Mercury Payments; MICROS; Online Resources (ORCC); RBS WorldPay; Skipjack; SunTrust Merchant Services; Transaction Network Services (TNS); TSYS; United Bank Card; VeriFone; Visa; Wells Fargo Merchant Services.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.For more information and media inquiries, please call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Book a Meeting with the Author

Related content

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Honor All Cards: The U.S. Credit Card Model Takes a Hit

The Honor All Cards principle—that any merchant with a Visa and/or Mastercard sticker in the window accepts all card products on those networks—could be undermined by a recent sett...

Make informed decisions in a digital financial world