Processing Recurring and Subscription Payments Without Friction: A Key to Unlocking Transactions from a Forecasted $830 Billion Card Market

- Date:February 23, 2022

- Author(s):

- Ben Danner

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

Subscription and Recurring Payments Is a Large Market with Lots of Opportunity

Recurring payments is a high-growth market in the U.S. and is expected to generate $830 billion in transaction volume by 2025. In this report, we define recurring payments and analyze the U.S.

consumer market for various recurring payment types, with a particular emphasis on the subscription marketplace. Merchants need to find ways to optimize solutions for common payments

issues with chargebacks and involuntary cardholder churn. Issuers need to be paying attention to the developments in the subscription app marketplace. Furthermore, this research explores last year’s regulatory changes to recurring payments in India.

“Reducing friction is the key to customer generation and retention,” comments Ben Danner, Analyst, at Mercator Advisory Group, and the author of the research report. There are a number of opportunities that exist to develop and refine the recurring payments economy.

This report is 24 pages long and contains 11 exhibits.

Companies and Apps mentioned in this report include: Consumer Financial Protection Bureau (CFPB) ; Truebill, Hiatus, Billbot, BillGO, Bobby, Subby, Mint, First Performance, Chargebee, Recurly, Cash App, Netflix, Apple, Reserve Bank of India, Spotify, Visa, Mastercard, Subscribed Institute, GoCardless, American Express, Amazon, AT&T, Audible, CBS, Disney, ESPN, Fubo TV, HBO, Hulu, iHeartRadio, Luminary, MLB.TV, NBA League, NHL.TV, Pandora, Showtime, Sling TV, SiriusXM, Stitcher, YouTube, Vudu, Headspace, Inc., Verizon, US Bank, Wells Fargo, Prism, Mollie.

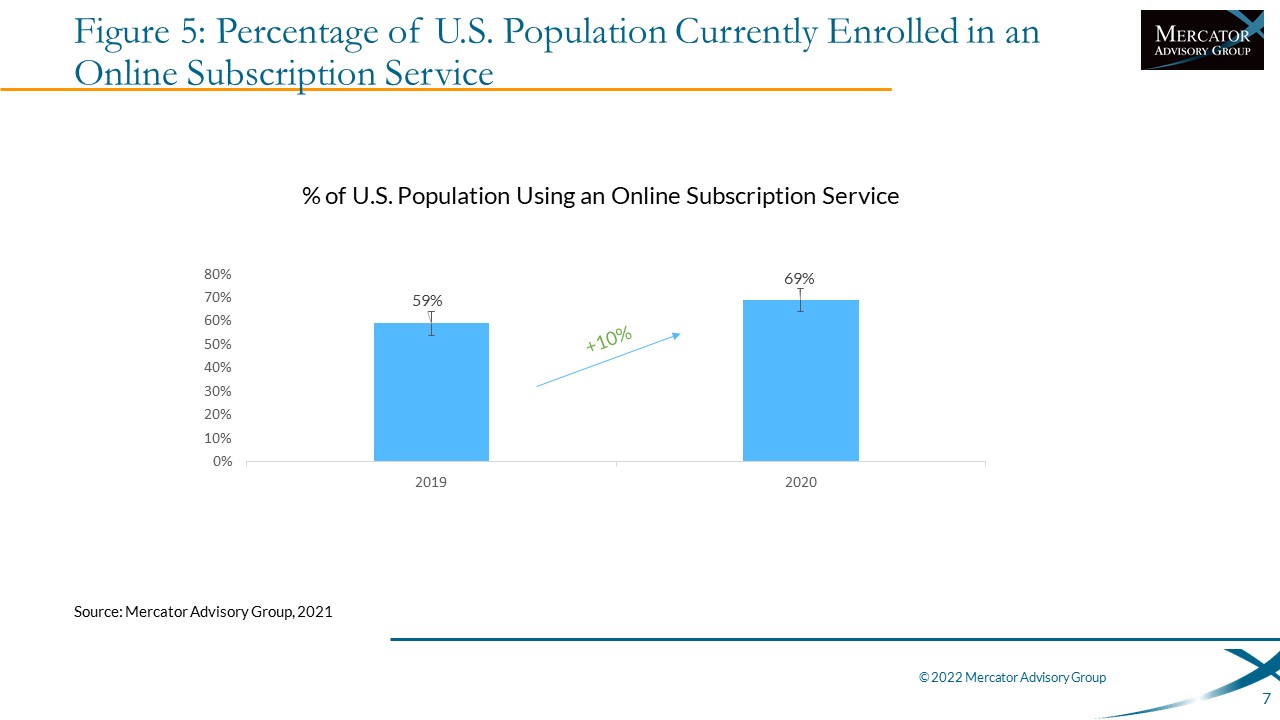

One of the exhibits included in this document:

Highlights of this document include:

- Recurring payments market analysis and forecasting

- Payment methods used for subscriptions services

- How subscriptions effect credit cards and rewards

- Optimizing churn rate, payments failures, and chargebacks

- Personal finance apps and the subscription marketplace

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world