Private Label Credit Cards Update: New Opportunities, New Competitors

- Date:December 31, 2019

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

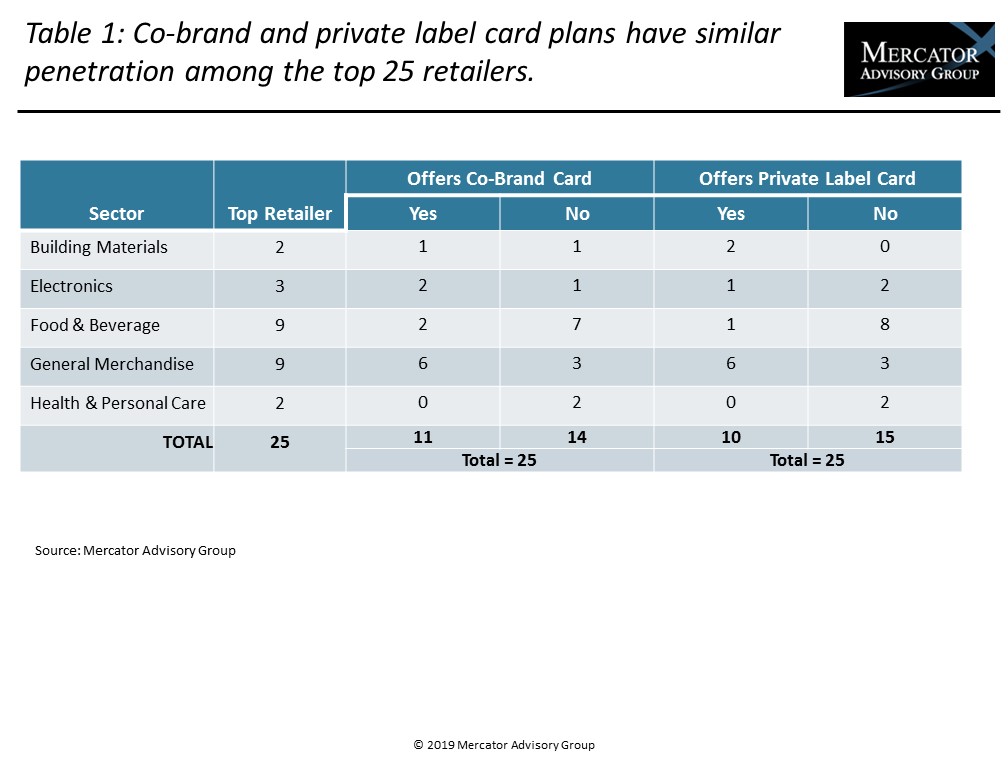

In spite of their many advantages and widely deployed infrastructure, private label credit cards (PLCCs) are now subject to new competitive market forces in the U.S. market. Yet they remain an essential credit vehicle. They have successfully been adapted and grown over decades. They continue to show flexibility as retailers refresh their offerings, and they continue to enjoy a major numeric advantage in number of accounts compared to the newer transactional credit accounts. The analysis presented in Mercator Advisory Group’s latest research report, Private Label Credit Cards Update: New Opportunities, New Competitors, reviews strategic developments and product outlook for private label credit cards and their stakeholders.

“The ability of the PLCC industry to remake itself and grow over the decades is remarkable, and it continues to attract new issuers and program sponsors. The competitive challenges facing retailers in adjusting the mix of online versus physical store sales creates strategic challenges for all stakeholders,” commented the author of the research report, Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group. “But innovative programs ensure PLCC products will keep pace with the needs of retailers and their customers.”

This research report contains 19 pages and 12 exhibits.

Companies and other organizations mentioned in this research report include: Alliance Data/Comenity, Amazon, Apple, Capital One, Chase, Citibank, Discover, Goldman Sachs, US Bank, Synchrony, TD Bank, and Walmart.

One of the exhibits included in this report:

- Consumer survey data documenting U.S. cardholders’ shifts in product use and inclinations to use alternative credit at checkout or point of sale (POS)

- Trends in PLCC accounts versus general purpose cards and unsecured personal loan products in the United States.

- The competitive environment of PLCC issuer competitors

- A review of the leading retailer programs and issuing partners

- Product innovations reshaping the PLCC landscape, including secured PLCCs and semi-closed loop PLCC programs

Book a Meeting with the Author

Related content

2026 Credit Card Risk: Happy Days are Here Again (For Top Issuers)

The year bodes well as 2026 approaches the end of the first quarter. Economic indicators are strong, the credit card market is growing at a healthy rate, and credit cards rem...

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Make informed decisions in a digital financial world