Overview

As the countdown clocks remind us every day, the EMV October 2015 liability shift in the United States is quickly approaching. For debit card issuers, a series of sizable market and technical obstacles have prevented issuance projects from getting off the ground. Available solutions were not compliant with regulations, interchange rates were further threatened by a lawsuit tied up in federal court, and resources became scarce as credit card issuers, not faced with these problems unique to debit issuance, got to the market first to claim production resources as well as personnel with EMV knowledge to guide projects.

Mercator Advisory Group’s research note, Predictions for the U.S. Migration to EMV Debit Cards, explores how the issuance of EMV debit cards is progressing in the United States now that many of the barriers have been removed. Financial institutions are taking different approaches that will create a variety of experiences for consumers at the point of sale. A mix of magnetic-stripe and EMV chip debit cards will coexist and merchants too will be in various stages of their EMV conversion for some time.

“The variety of approaches to EMV debit deployment is as varied as there are issuers. Some are reissuing on an expedited timetable, some will include EMV with their already planned reissue schedule, and others will issue only to customers who are international travelers and those who request chip cards. What is certain is that the majority of debit cards will not be EMV capable for years,” comments Sarah Grotta, Director, Debit Advisory Service at Mercator Advisory Group and author of the research note.

This research note has 12 pages and 5 exhibits.

Organizations mentioned in this research note include: EMVCo, JP Morgan Chase, MasterCard, Secure Remote Payment Council, Smart Card Alliance, Target, and Visa.

Members of Mercator Advisory Group’s Debit Advisory Service have access to these notes as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

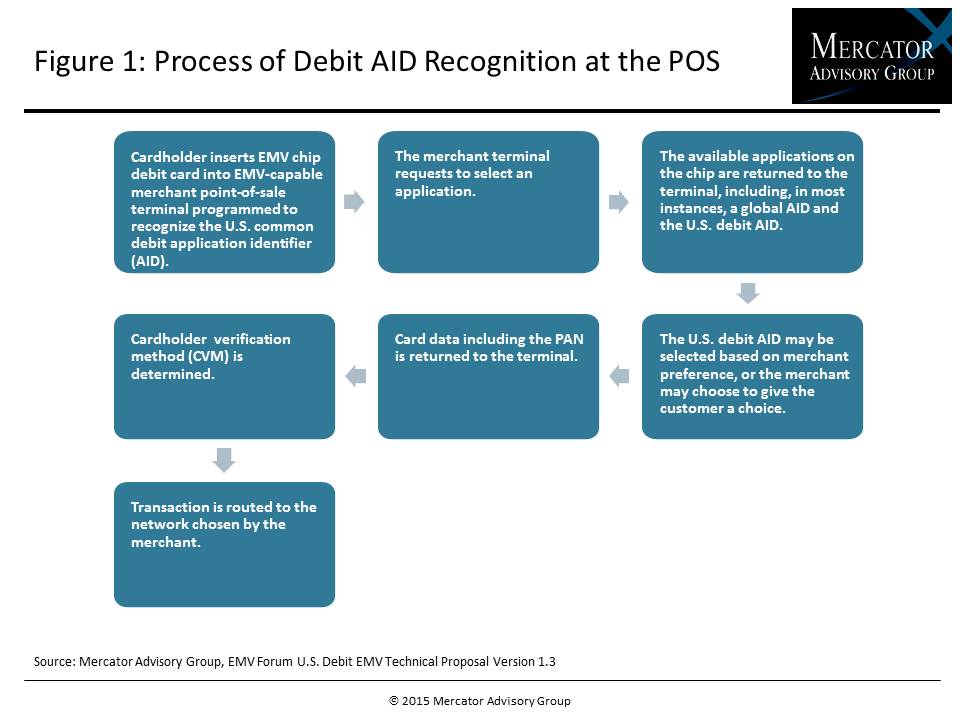

One of the exhibits included in this report:

- The series of events that transpired to slow the adoption of EMV for debit in the United States

- U.S. debit issuers’ approaches to EMV issuance

- How the common debit application identifier (AID) is deployed and selected at the point of sale

- Types of interactions cardholders and merchants will experience as a mix of payment technologies are present in the marketplace

- Mercator Advisory Group’s predictions for EMV debit card volume predictions for the roll-out of EMV cards, 2015–2018

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world