Overview

All brick-and-mortar merchants need to reduce their overhead costs in a time of reduced sales volume. Many merchants may be unaware of some alternative and emerging payment channels that are available to them and fail to take advantage of other ways in which in-store shoppers can pay. These are systems that are not routed through the established payment card networks and feature lower transaction fees.

A new research report from Mercator Advisory Group, Payment Channel Alternatives to the Card Networks for Merchants, describes the ways that consumers can pay for transactions in stores and how merchants can integrate these payment acceptance methods into their point of sale (POS) systems. Most retailers, especially small businesses, can save money on card processing fees (interchange) and related fees thanks to some existing technologies as well as more recent API developments from payment providers.

“Merchants are looking for ways to save costs in times of low growth or no-revenue growth and shrinking profit margins. Now they have some viable ways to save on processing costs for sales transactions by offering their shoppers some alternative payment methods,” commented Raymond Pucci, Associate Director, Research Services at Mercator Advisory Group, and author of the report.

This report is 15 pages long and has 6 exhibits.

Companies mentioned in this report: American Express, Best Buy, Circle K, CITGO, Cumberland Farms, Chase, Discover, First Data, GasBuddy, Mastercard, Speedway, Starbucks, Target, Vantiv, Venmo, Visa, Walmart, Wex, Zelle, and ZipLine.

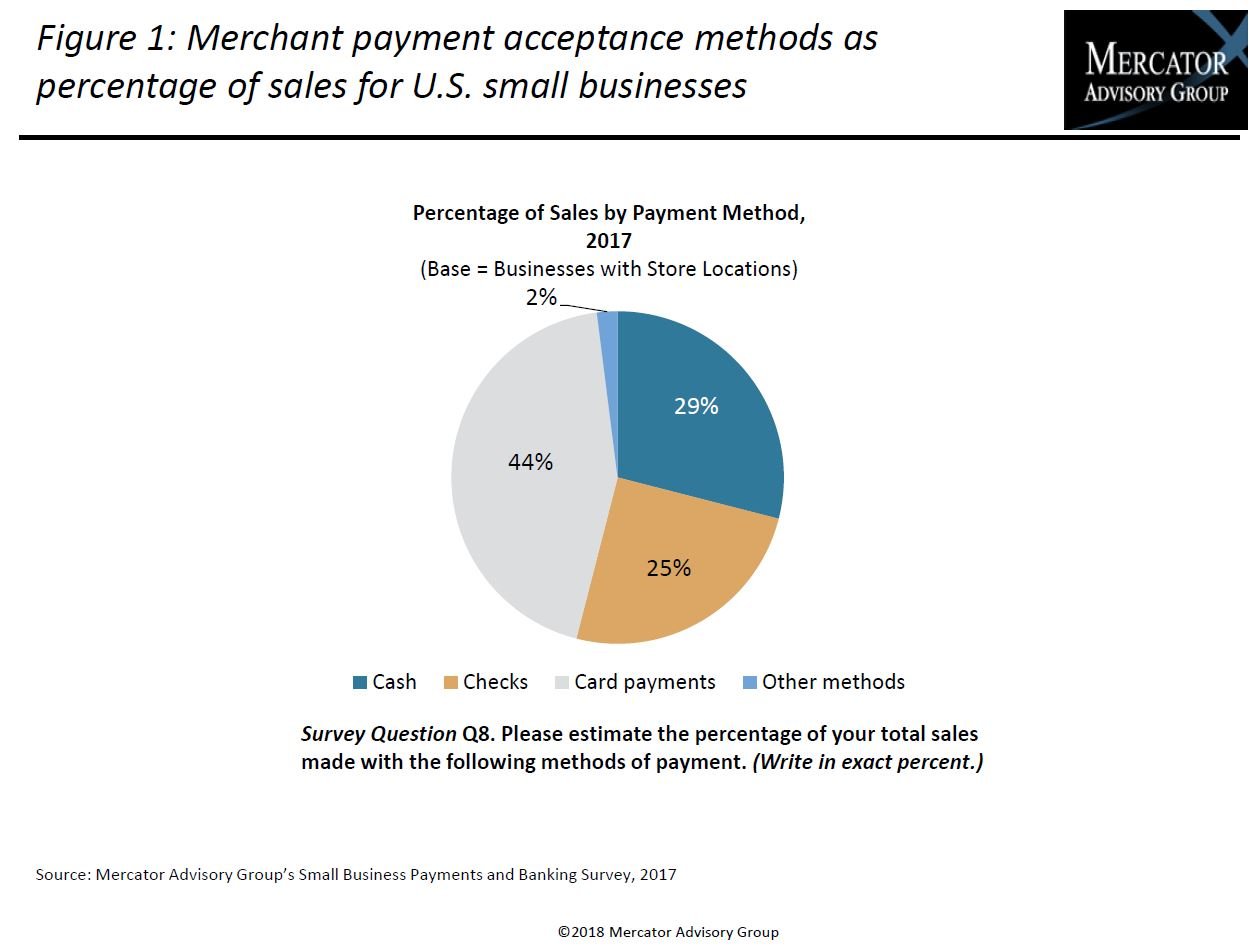

One of the exhibits included in this report:

Highlights of this research report include:

- Consumer in-store payment preferences

- Types of merchant payment channel alternatives

- Emerging decoupled debit payment methods

- Merchant pains and gains from card networks

- Merchant payment transaction processing fee examples

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world