Overview

A new research report by Mercator Advisory Group, Operational Excellence: The Best Debit Marketing Strategy, recommends that the best way to increase debit card usage and customer retention is to improve dispute handling and reduce the incidence of false positives in fraud detection.

“Debit has gotten a bad reputation in the popular press for being unsafe and less accepted, particularly in digital channels. To counteract this sentiment, banks and credit unions are re-examining their approach to handling cardholder disputes to make it less disruptive to consumers and the underlying activity in their checking accounts. Issuers are also focused on fine-tuning their transaction monitoring tools to protect transactions without being so restrictive as to turn away too many legitimate transactions,” commented Sarah Grotta, Director, Debit Advisory Service at Mercator Advisory Group and author of the report.

This report has 14 pages and 5 exhibits.

Companies mentioned in this report include: CO-OP Financial Services, Mastercard, and Visa.

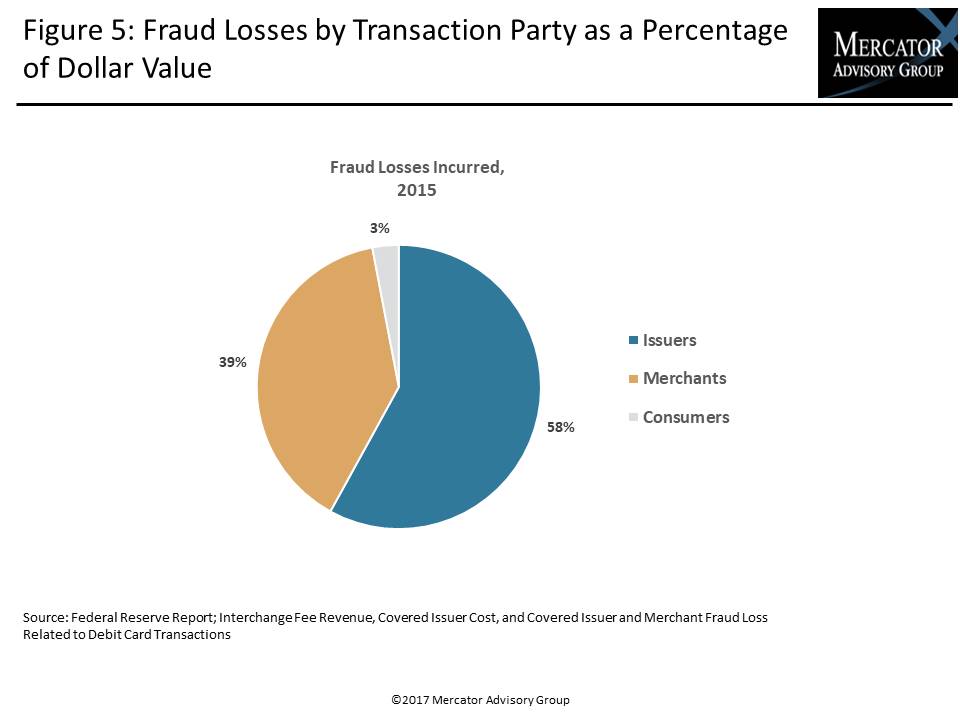

One of the exhibits included in this report:

- Decline in the use of debit cards compared to credit cards for retail purchases in the United States

- Transaction types that consumers prefer in digital channels

- Trends and best practices in handling debit card disputes

- The rising risk of “friendly fraud”

- Discussion regarding the use of data analytics to curtail false positives

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world