Overview

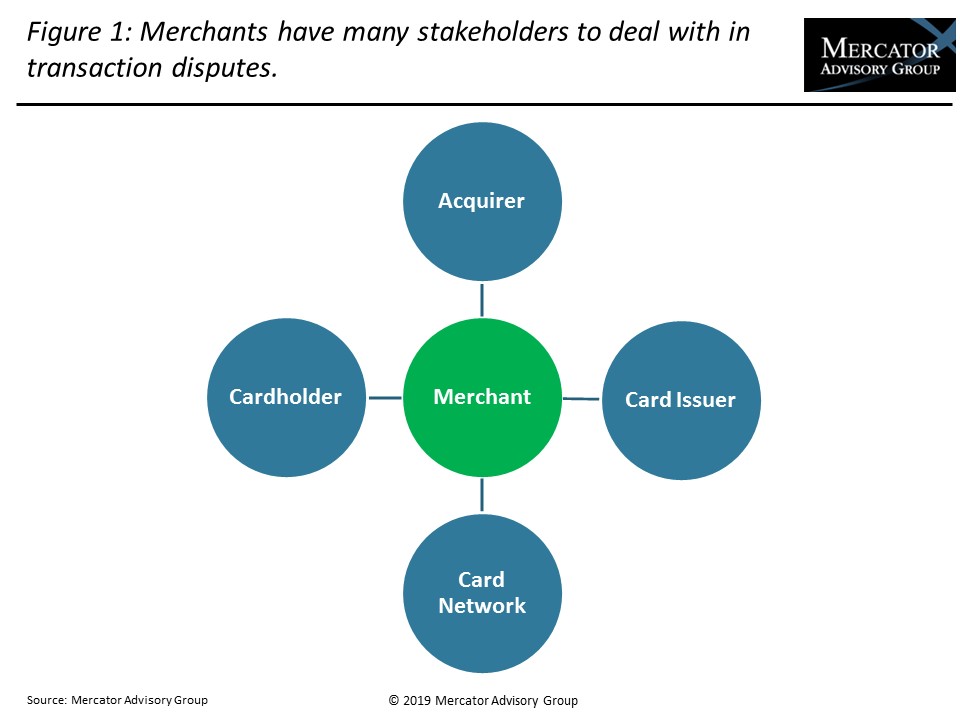

Merchants find themselves wrestling with the chargeback process, which is triggered when consumers dispute a purchase transaction, mostly on e-commerce sales. Increasingly, friendly fraud has also become a direct cause of merchant chargebacks. This report delves into chargeback reasons and implications as well as vendors of chargeback services that have emerged to provide solutions for merchants.

A new research report from Mercator Advisory Group, Merchant Chargebacks Are on the Rise Due to Friendly Fraud assesses the challenges and preventive solutions for this increasing problem that affects merchants of all sizes across vertical markets.

“Merchants are incurring a major pain point dealing with consumer-disputed sales transactions that can lead to chargebacks. This can mean merchants lose not only the sales revenue but also the merchandise and related overhead costs as well,” commented Raymond Pucci, Director, Merchant Services at Mercator Advisory Group, the author of this report.

This report is 14 pages long and has 2 exhibits.

Companies mentioned in this report: ACI Worldwide, American Express, Authorize.Net, BlueSnap, Braintree, CardinalCommerce, Chargeback, Chargebacks911, Chargeback Gurus, Chargehound, CyberSource, Discover, Ethoca, Federal Reserve Board, Lexis-Nexis, Mastercard, Midigator, PayPal, Stripe, Verifi, and Visa.

One of the exhibits included in this report:

Highlights of this research report include:

- Ease of the customer dispute process

- Why friendly fraud has been linked to chargebacks

- How crafty consumers game the dispute system

- Market data estimates of chargebacks and friendly fraud

- How merchants are combatting chargebacks

- Brief profiles of chargeback service companies

Book a Meeting with the Author

Related content

Agentic Commerce: Green Light or Flashing Yellow for Merchants?

Agentic commerce is forecasted to reach $500 billion in sales by 2030, but what’s driving that growth? Consumers will vote with their wallets on which product categories and sales ...

Merchants Should Planogram Payments

Enterprise merchants have increasingly adopted payment orchestration strategies to drive new payment types, increase payment success rates, and optimize platform performance. Howev...

2026 Merchant Payments Trends

As payment technology advances and offers greater options and flexibility for consumers, merchants are put in the position of prioritizing how to manage payment acceptance, what pl...

Make informed decisions in a digital financial world