Overview

The statement “The merchant services business isn’t really about payments” is truer today than ever. Developers of integrated payments software have rapidly broadened the availability of sophisticated processing solutions across industry verticals. And firms that would never before have been considered “payments” companies are now earning substantial payments revenue. Leading merchant acquirers have already set the course for their integrated payment strategies, but independent sales organizations are looking increasingly vulnerable to this new competition.

Mercator Advisory Group’s research note, Merchant Acquiring in 2014: Integration, Integration, Integration, discusses how acquirers and ISOs should be responding to the integrated payments revolution occurring in the United States.

“Integrated point-of-sale solutions are expanding the market for merchant services in the United States,” comments Michael Misasi, Senior Analyst, Credit Advisory Service at Mercator Advisory Group and the author of the research note. “These solutions help small businesses justify the cost of payment acceptance and are facilitating card acceptance in industries with relatively low rates of bank card acceptance. The firms that successfully manage the transition to integrated payment applications will be rewarded with larger payment volumes and more profitable business.”

This note contains 12 pages and 5 exhibits.

Companies mentioned in this research note include: APT, Bank of America Merchant Services, Blackbaud, CardConnect, Chase Paymentech, Century Payments, Clover, Cynergy Data, Elavon, Element Payment Technologies, EVO Payments International, First Data, Global Payments, Heartland, Leaf, Mercury Payments, MCS, Merchant Warehouse, Micros, NCR, Oracle, PayPros, ProPay, Priority Payments, Phreesia, TouchNet, TransFirst, TSYS, Vantiv, WorldPay, and Xpient.

Members of Mercator Advisory Group’s Credit Advisory Service have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

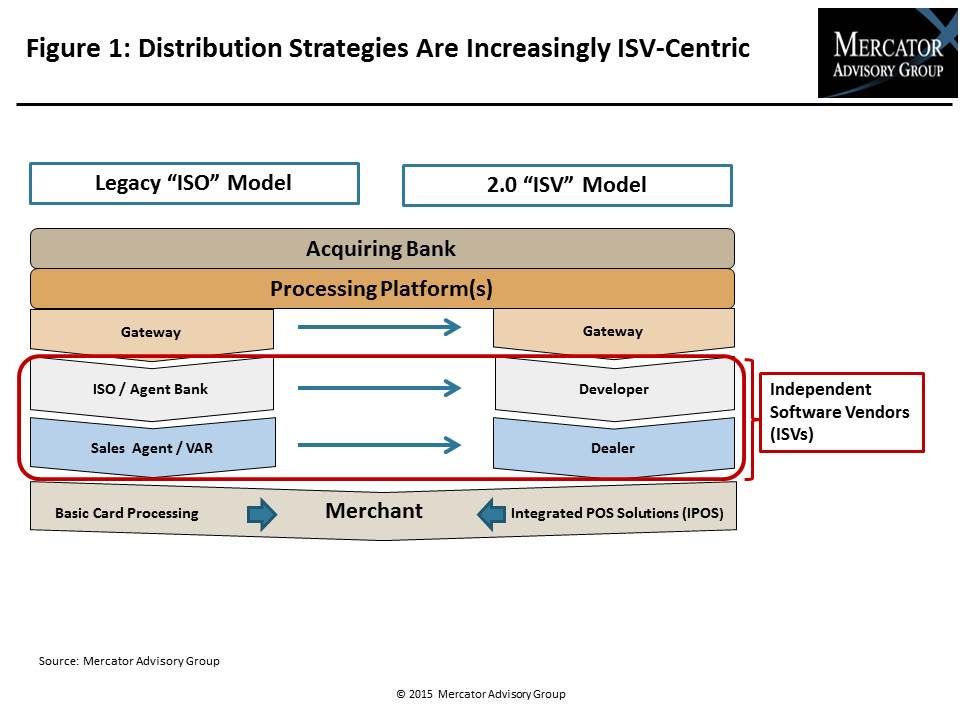

One of the exhibits included in this report:

Highlights of the research note include:

- Estimated 2014 market shares of leading acquirer processors

- An explanation of the emergence of independent software vendors as a delivery channel for merchant services and what that means for acquirers’ industry vertical strategies

- Analysis of how ISOs, acquiring banks, and processors can respond to the new integrated payments environment

- An overview of integrated payment offers from leading acquirer processors

- Examples of software companies successfully delivering payments as a service

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world