Overview

Neo-banks Are experiencing both profound growth and significant challenges.

Since their inception, neo-banks have attracted large customer bases and significant venture capital backing. Their approach to the business of banking is markedly different than traditional financial institutions, and some are rightfully wary of the threat they represent. Still, neo-banks themselves face numerous challenges—regulatory, financial, and otherwise. Mercator Advisory Group’s latest research report, A Maturing U.S. Neo-Bank Market: Growing Pains and Opportunities, discusses the neo-bank market in the U.S. and predicts what the future may hold for these companies.

“The future is uncertain for neo-banks. Powerful new entrants are seeking a share of the neo-bank market. Venmo—owned by PayPal—is increasingly pursuing banking functions, and Walmart has expressed its intent to expand into the market as well. More important, neo-banks will need to find their own pathways to profitability. With their emphasis on limited fees and focus on bank accounts and debit products, neo-banks, for the most part, are not generating large profits,” comments Laura Handly, market research analyst at Mercator Advisory Group and author of the report.

This report has 18 pages and 2 exhibits.

Companies mentioned in this report include: Ally Bank, Aspiration, Axos Bank, Bancorp Bank, Barclays, BVVA, CapitalOne 360, Charles Schwab, Cheese, Chime, Choice Bank, Daylight, Douugh, E*Trade, Evolve, First Boulevard, Golden Pacific Community Bank, Goldman Sachs, Green Dot, JPMorgan Chase, MetaBank, Middlesex Federal Savings Bank, N26, PayPal, PNC Bank, Simple Bank, SoFi, Synchrony, The Clearing House, Varo Bank, Venmo, and Wal-Mart.

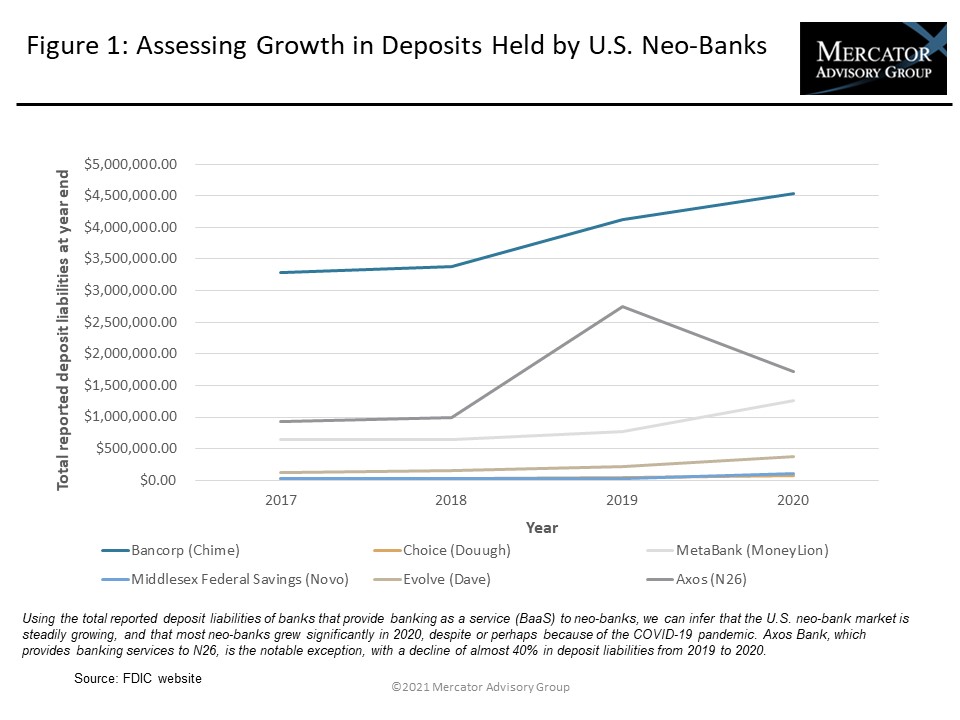

One of the exhibits included in this report:

Highlights of the report include:

- Analysis of trends within the U.S. market and discussion of the effect that the Covid-19 pandemic has had.

- Mapping of five different segments of digital banking and examination of the ways in which neo-banks are distinct from the other four segments.

- Review of the banking charters available to neo-banks, with examples of companies that have chosen each type.

- Assessment of the primary threats facing neo-banks, including heightened competition, consolidation within the market, and stricter regulations.

- Predictions for the future of the market, including trends towards greater personalization and the pursuit of profits.

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world