Overview

Boston, MA

November 2003

Loyalty Programs:

Chip's Real Potential Unlocked

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

Until now, smart card industry in the U.S. hasn't found the magic application that will motivate merchants to replace POS terminals and expedite back office upgrades. Smart card-based loyalty programs can be the catalyst, and create a snowball effect in the solution of this "who moves first?" problem.

In a new research report "Loyalty Programs: Chip's Real Potential Unlocked", Mercator Advisory Group examines innovative loyalty programs and their strategic implications for the businesses in the payments industry.

Loyalty programs are used to increase acquisition, retention, usage, and average ticket and thus revenues. According to Evren Bayri, author of the report, "influencing consumer behavior through rewards can facilitate implementation of various business strategies. Business goals that are effected by and require a change in consumer preferences at the POS such as using a smart card instead of a magnetic stripe card or making offline debit transactions rather than online debit transactions can be accomplished through a carefully planned loyalty program."

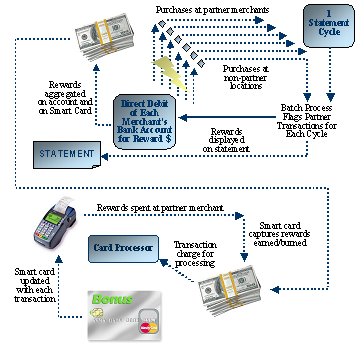

The report examines the synergies between loyalty programs and smart cards: i.e. Loyalty programs can help to expedite the smart card penetration as smart card technology offers the ability for more data intensive programs that will add value for both cardholders, issuers and merchants alike. As a matter of fact, Bonus Card, a MasterCard co-branded smart card with a coalition loyalty program developed by Incline Village, NV-based Quantum Loyalty Systems and Istanbul, Turkey-based Garanti Bank, reached 1.8 million members with a network of 650 program partners at 17,000 merchant locations after 2 years of its initial launch in 2000.

The demand for loyalty programs is still present and it is growing significantly as can be seen by the number of vendors that offer loyalty solutions and the range of their offerings. The report provides a high level overview of loyalty programs, examines sample loyalty programs highlighting successful strategies, and provides a compilation of loyalty solution vendors and their solutions.

This report contains 27 pages and 9 exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 508-845-5400 or send email to [email protected].

Book a Meeting with the Author

Related content

2026 Credit Card Risk: Happy Days are Here Again (For Top Issuers)

The year bodes well as 2026 approaches the end of the first quarter. Economic indicators are strong, the credit card market is growing at a healthy rate, and credit cards rem...

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Make informed decisions in a digital financial world