Overview

Boston, MAFebruary 2008

International B2B Payments:

State and Future of the Marketplace

NEW RESEARCH REPORT BY MERCATOR ADVISORY

Mercator Advisory Group announced today the availability of its latest report, International B2B Payments: State and Future of the Marketplace. This report delivers a B2B payments growth forecast, an overview of Business-to-Business (B2B) payments, how businesses communicate their payments and information, major payments networks basics, and the leading bank processors.

This report sets the stage for further B2B content as Mercator Advisory Group continues its coverage of the United States payments market which includes separate forecasts of checks, ACH, CHIPS, and Fedwire volume through 2010. The report reviews how B2B payments are processed by companies and the pros and cons of each method.

The report covers issues, concerns, and the future of the payments market as reported to Mercator from senior industry sources. They speak from experience and frustration about their day to day interaction with payments networks, various payments methods, and the barriers to future progress.

Highlights of the report include:

- Banks are struggling to serve many masters; some with like goals and others with contradictory ones. Regulators, corporate clients, Boards of Director, and shareholders are pulling in their own directions

- Some payment types are declining while others are picking up that slack ACH, CHIPS, and Fedwire payments are taking the place of B2B check.

- Businesses of all sizes are trying to send payments in the most cost-effective way and not through the bank established channels. New non-bank entities will arise to fill the void

- There are a few large banks that process most of the B2B payments in the US. Most of these banks are also based in the US, but two are foreign banks

- Corporate financial professionals want a conversion from paper to electronic payments, but only if they can get the payment information with the money transfer

"The B2B payments industry in the US and in other countries is struggling with an identity crisis. Regulatory authorities are demanding that the payments industry tighten their reins on the adherence to regulations and compliance mandates; technology is enabling payments providers, banks, and network to venture further into new frontiers; practitioners are worried about security; and infrastructures are getting old and in need of repair or replacement, states Tim Sloane, Research Director at Mercator. The task of replacing these systems is so daunting; no wonder no one wants to launch a project to overhaul the enterprise payments network within the business or within the banks."

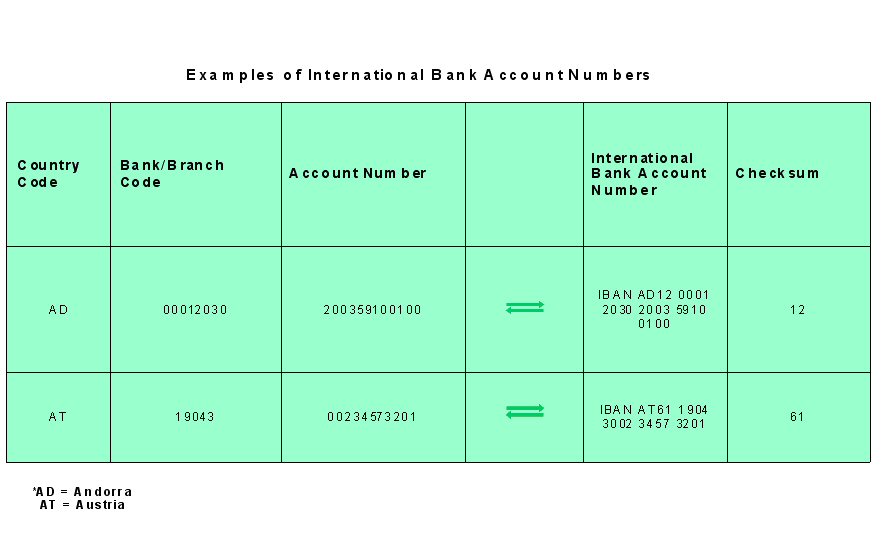

One of the 13 Exhibits included in this report:

This report is 27 pages long and contains 13 exhibits and tables. Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com/.For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

State of Debit 2026

Despite headwinds that include significant financial strain on consumers despite a broadly stable economy, debit remains resilient—especially among younger consumers and lower inco...

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Make informed decisions in a digital financial world