Installment Lending: Fintechs Gaining Ground on Loans Forecast at $212 Billion

- Date:March 14, 2022

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

Banks and Credit Unions Lose Scale on Loans as Fintechs Grow

Mercator Advisory Group released a report on trends in installment lending titled Installment Lending: Fintechs Gaining Ground on Loans Forecast at $212 Billion. The research explains the state of consumer installment lending in the United States and how fintechs and finance companies now outpace banks and credit unions in installment loans. Furthermore, this research examines how companies are offering embedded finance products such as CCaaS to allow customers the ability to offer their own credit card product. By way of four evaluative criteria, general advice is provided for those seeking a relationship with a fintech provider.

“Banks used to dominate consumer lending, with installment lending products priced far lower than credit cards, but that is no longer the case,” comments Brian Riley, Director of the Credit practice at Mercator Advisory Group, and the author of the research report. “Buy Now, Pay Later (BNPL) was a wake-up call to credit card issuers. BNPL was a recast of a merchant finance model used long ago by companies like GECC (now Synchrony) and Household Finance Corporation (acquired by Capital One). Now, fintechs are moving in the same direction with installment loans,” Riley says.

This document contains 28 pages and 9 exhibits.

Companies mentioned in this research note include: Acima Credit, Affirm, American Express, Avant, Bankrate, Blend Labs, Bread, Capital One, Citi, Discover, Equifax, Experian, FIS Global, FICO, Fiserv, GECC, HFC, JPMorgan Chase, Jack Henry, Klarna, Lending Club, LightStream, Mastercard, NerdWallet, Opportun, Prosper, Regions Bank, Rocket Companies, SoFi, Synchrony, TSYS, Truist, TransUnion, Upgrade, Upstart, Visa, Wells Fargo, Worldpay, Zopa

One of the exhibits included in this document:

Installment Lending: Fintechs Gaining Ground on Loans Forecast at $212 Billion

Highlights of this document include:

- U.S. consumer debt trends

- Fintech and finance company trends versus financial institutions

- Why banks and credit unions should define the consumer lending space, not follow fintech trends

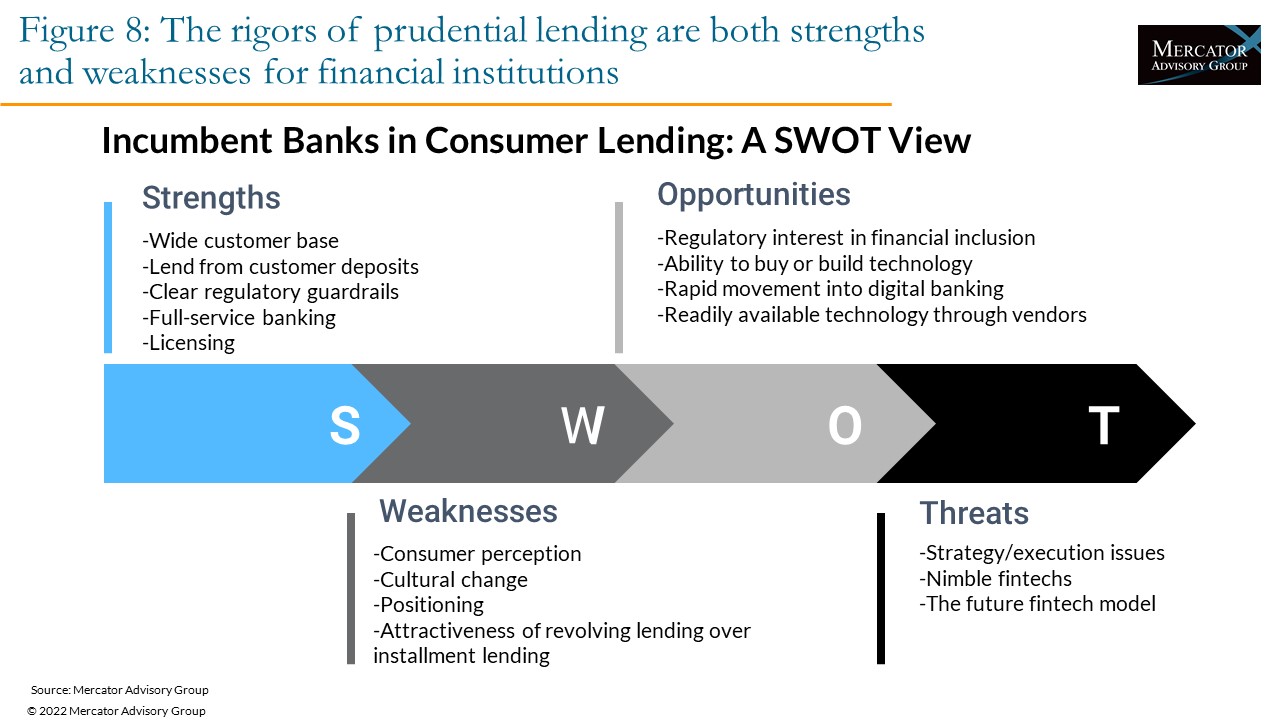

- Strengths, weaknesses, opportunities, and threats for incumbent banks and fintechs

- Comparison of revolving and installment lending products

- Consumer survey data on installment loan users and major fintech lenders

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world