Overview

Hybrid Cards: I'll Have Two of Everything

Report Examines Market Opportunities for Hybrid (Dual Function) Cards

Boston, MA -- In new research, Hybrid Cards: I'll Have Two of Everything, Mercator examines the characteristics that comprise a dual-function card in order to create a definition and framework for considering hybrid card opportunities in the market.

Before electronic wallets and virtual accounts become ubiquitous, the payments industry will continue to rely on plastic cards as the primary form factor. Thus, issuers around the world are putting hybrid cards in their consumers' pockets for myriad purposes and new technologies are being developed that serve to further enhance plastic card functionality. In addition, the practice of leveraging subaccounts to segregate purchases into distinct repayment categories to create hybrid accounts has roots in major issuer strategies, such as American Express' Sign and Travel, as well as new products, like Chase's Blueprint.

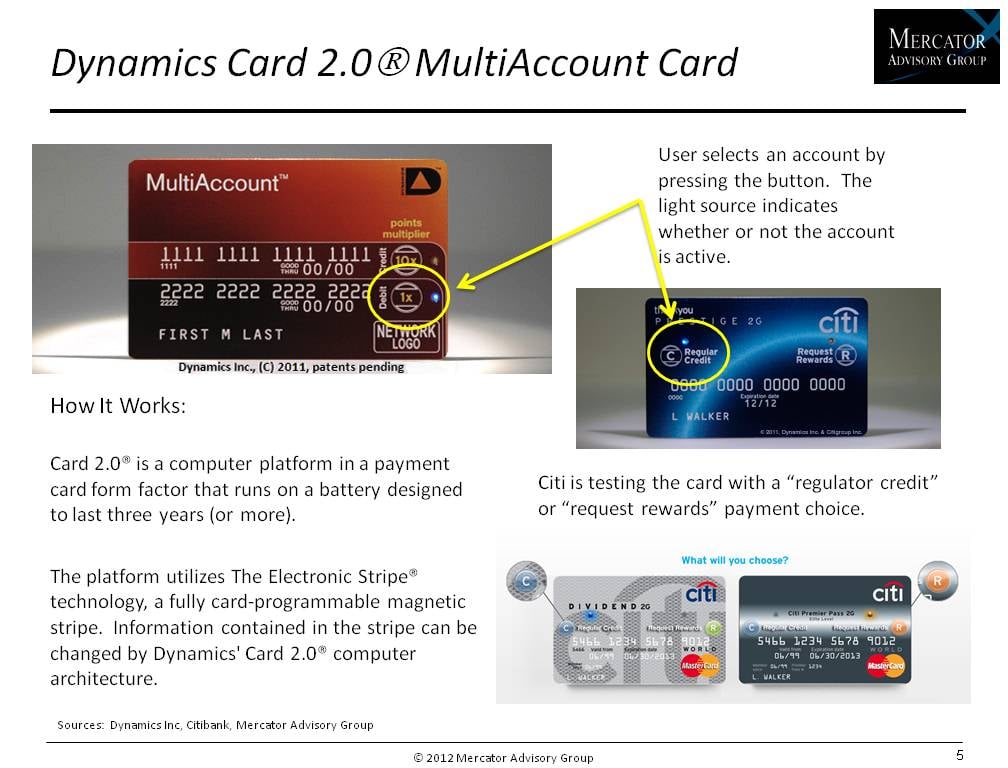

Major U.S. issuers, including Fifth Third and CitiBank, are offering cardholders hybrid card products as a means of expanding their brand value and offering consumers convenient access to broader categories of spend.

This report reviews this dynamic market, offers examples of hybrid card executions, and examines critical aspects within the development environment.

Major Highlights of This Report Include:

An examination of the business drivers, market dynamics, and technical advancements that have resulted in the creation of a wide variety of hybrid cards and accounts.

An analysis of the major characteristics that make up a hybrid card and a resulting definition.

A review of the seven different types of hybrid cards including examples.

A case study of the Fifth Third DUO card based including product strategy, best practice guidelines, and near term results of the product operating in-market.

"The challenge of expanding issuer brand equity in a market that has become highly fractionalized is a primary problem financial institutions are trying to solve in the United States. Issuing a hybrid card can be a solution that bridges the gap between legacy and emerging payment forms and creates a product construct that is more valuable...," Patricia Hewitt, director of Mercator Advisory Group's Debit Advisory Service comments.

One of 13 exhibits in this report:

This report is 28 pages long and has 13 exhibits.

Companies mentioned in this report include: Fifth Third Bancorp, CitiBank, Wells Fargo, First Data, TSYS, Dynamics, American Express, AAA, Costco, JPMorgan Chase.

Members of Mercator Advisory Group's Debit Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

For free industry news, opinions, research, company information and more visit us at www.PaymentsJournal.com.

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors. Mercator Advisory Group is also the publisher of the online payments and banking news and information portal PaymentsJournal.com.

Book a Meeting with the Author

Related content

State of Debit 2026

Despite headwinds that include significant financial strain on consumers despite a broadly stable economy, debit remains resilient—especially among younger consumers and lower inco...

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Make informed decisions in a digital financial world