Overview

Boston, MA

July 2006

Extending The PIN: Evaluating The Growth of EFT Networks Into New Markets

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

The debit industry has seen significant growth over the last eight years, while signature debit growth is down ever so slightly from 21 percent in 2003 to 18 percent in 2005. PIN debit has more than compensated accounting for between 35 to 38 percent of all debit transactions in the same time period. As a result of these two spectacular increases, debit transactions either already have, or will very soon, exceed credit transactions.

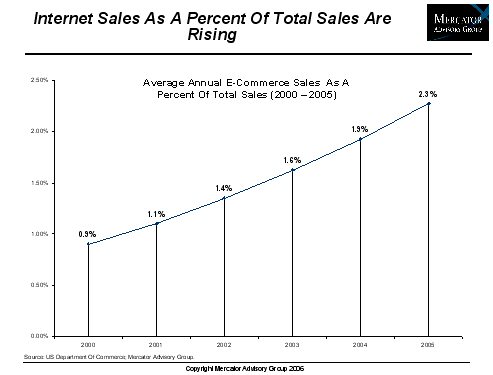

Despite debit's incredible growth in volume terms Mercator Advisory Group believes that the EFT networks that enable PIN debit are approaching a critical juncture. Signature debit, while currently facing a slightly slowing growth rate, is also the only debit solution fully enabled and successfully entering several new emerging markets, such as eCommerce, recurring bill payments, and those markets where cash is being displaced using Contactless and signature-less solutions. Left unchecked the increased growth in internet and mobile payments and cash replacement will occur primarily at the expense of growth in EFT transactions. This will be of some concern if these new markets grow as quickly as proponents hope. It is important to note that we are talking about future markets and the relative market share of transaction types in these emerging environments.

This report evaluates the consumer preference for debit instruments today, how these preferences can be shifted by the popular press and the payment industry itself, the targeting of three new markets by card associations for future growth: 1) online transactions, 2) recurring bill-pay environments, and 3) Contactless/signatureless environments intended to displace low-value cash transactions, and issues that make it difficult for EFT network operators to react unilaterally to enter these same evolving markets; and therefore, make co-operative plays related to technology standards and implementation a real consideration.

Tim Sloane, Director of the Debit Service for Mercator Advisory Group and the author of the report indicates that despite strong growth rates across the board for debit, EFT network operators may need to start establishing plans to target these same markets.

"While predicting overall growth of all three evolving markets may be difficult, it is clear that internet payments will continue to grow significantly. If the recurring bills and cash replacement market segments also experience high growth, then EFT operators may find themselves facing a growing barrier to market entry not unlike that experienced when they had to deploy key pads on POS devices to enable PIN-based debit at the POS."

One of the 12 Exhibits included in this report

Figure 11: Debit Programs with High Average Purchase per Card.

The report contains 26 pages and 12 Exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Honor All Cards: The U.S. Credit Card Model Takes a Hit

The Honor All Cards principle—that any merchant with a Visa and/or Mastercard sticker in the window accepts all card products on those networks—could be undermined by a recent sett...

Make informed decisions in a digital financial world