Overview

Significant progress in the issuance of chip credit cards and the education of consumers has been offset by continued challenges in certifying and activating merchants’ dormant point-of-sale terminals to accept EMV transactions. The resulting blowback—lawsuits, product changes, and policy shifts—has come to define the U.S. EMV migration in 2016.

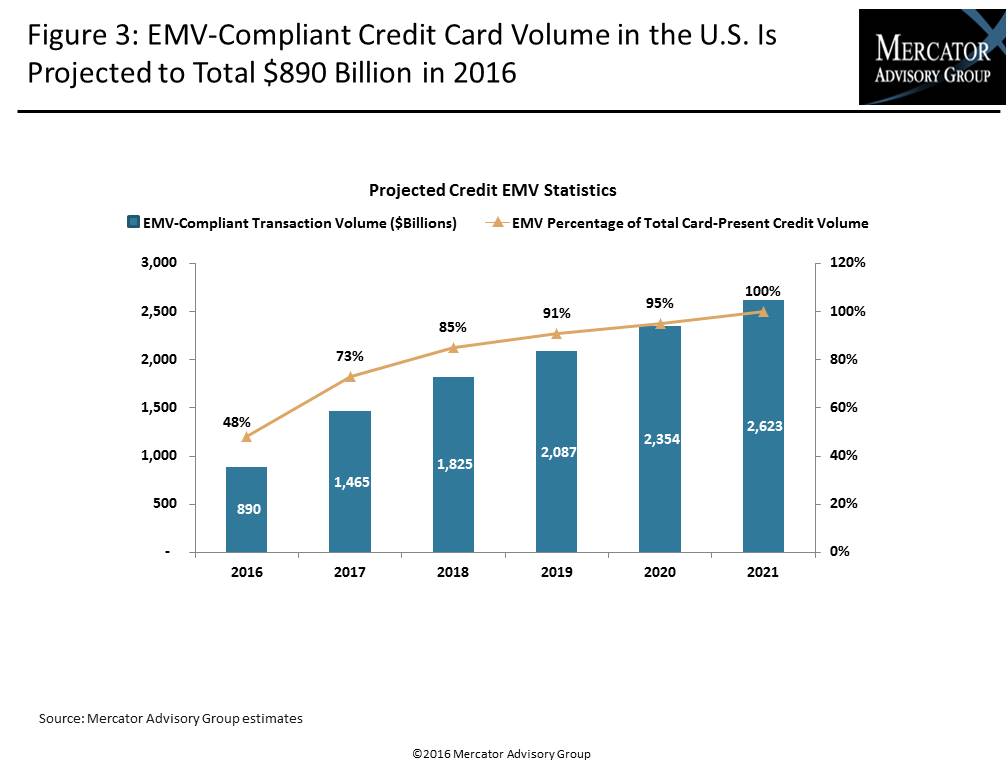

Mercator Advisory Group's newest research report, EMV in 2016: Breaking Through the Bottleneck, provides an updated outlook on the U.S. EMV migration, including estimates for the issuance of chip credit cards and the distribution and activation of chip-accepting point-of-sale (POS) terminals.

“Consumers have grown much more comfortable with chip cards over the last 12 months,” comments Alex Johnson, Director of Mercator Advisory Group’s Credit Advisory Service and author of the report. “This has thrown the ongoing challenges in activating merchant POS terminals into sharper relief. How merchants, acquirers, and the card networks resolve these challenges will shape the next 12 months of the U.S. EMV migration.”

This report contains 22 pages and 7 exhibits.

Companies mentioned in this report include: American Express, Citi, Costco, Discover, Home Depot, Kroger, MasterCard, Target, Visa, Walmart

One of the exhibits included in this report:

Highlights of the report include:

- Projections for the issuance of EMV credit cards and the distribution and activation of EMV-capable POS terminals

- Estimates for the volume of EMV-compliant credit card payments in the U.S. over the next five years

- A glimpse into Mercator Advisory Group’s latest proprietary consumer and small business survey results relating to EMV

- An exploration of the issues inhibiting the certification and activation of EMV-capable POS terminals and an overview of the changes announced by the card networks to address those issues

- A review of the policy shifts, product changes, and legal maneuvers that have been employed by merchants and the card networks to resolve key disagreements in the U.S. EMV migration

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world