Overview

The Growth of Super Apps Provides Opportunities for Financial Services

Some app providers are extoling the multitude of features their solution offers and have proclaimed that their particular app has achieved “super app” status. Because there aren’t any requirements or a common definition to acquire this title, any app provider can claim this status, and many do. This is the case for ride-hailing, person-to-person (P2P), and financial services apps in the U.S. But these apps are hardly equal to apps found in Asia, such as Alipay, Gojek, and WeChat, that offer a single digital door to mini apps that can be used for nearly every product and service available and can facilitate activity for every facet of life.

This report presents a view of the components of a true super app, outlines the features and functionality of some widely used U.S. apps that claim to be “super,” discusses where the payments industry fits within the ecosystem, and assesses the threats and opportunities that they represent to the financial services industry.

"The topic of super apps has been top of mind for bankers trying to determine the effect that some apps with a broad following could have on traditional financial services providers’ ability to attract and retain consumer customers and members. Recently, several app providers proclaiming their solution to be “super” have signaled increased focus on their app capabilities," comments Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group and author of the report.

This report has 21 pages and 6 exhibits.

Companies mentioned in this report include: Affirm, Alibaba, Amazon, American Express, Apple, Block, Capital One, Consumer Financial Protection Bureau (CFPB), Even, FDIC, Fiserv, Gojek, Goldman Sachs, Google, J.P. Morgan Chase, Mastercard, Meta, One, Paypal, Ribbit Capital, Synchrony Bank, Tencent, Tidal, Visa, Walmart, Whole Foods.

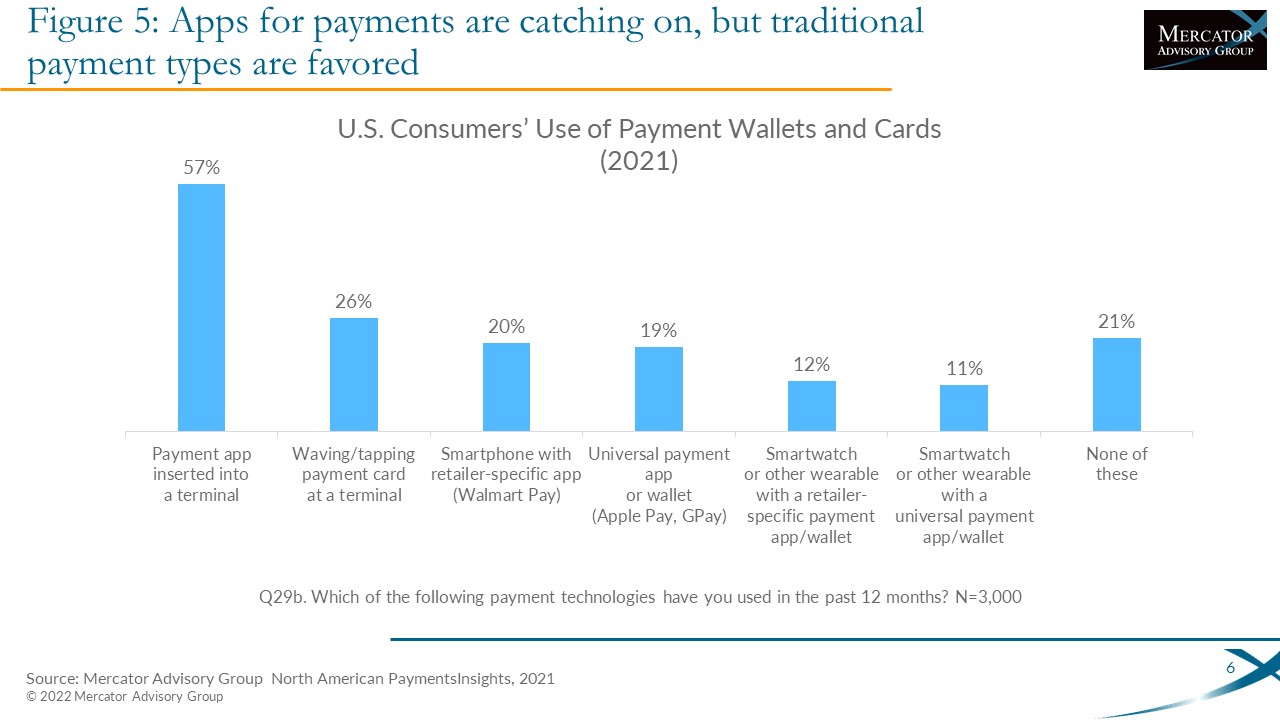

One of the exhibits included in this report:

The Emerging Age of the Super App

Highlights of the report include:

- What Is and What Isn’t a Super App

- Examining U.S. Contenders

- Why Asia-Style Apps Don’t Exist in the U.S.

- What Will Spark or Depress the Development in the U.S.

- Developing a Single, Universal, and Unifying UX

- Why Financial Institutions Should Care About the Development of Super Apps

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world