Overview

“Debit routing is in a state of flux at present. EMV and tokenization have taken their toll on the transactions flowing through EFT debit networks. By launching dual-message products, they can now compete for online and mobile transactions as well as gain access to merchants who haven’t incorporated PIN hardware,” comments Sarah Grotta, Director, Debit Advisory Service at Mercator Advisory Group and author of the report.

This research note examines how the networks evolved to this point in their history and how dual message could dramatically impact the debit market should merchants believe the financial benefits are sufficient.

This report has 10 pages and 3 exhibits.

Companies mentioned in this report include: Accel, Discover, First Data, FIS, Fiserv, Jeanie, MasterCard, NYCE, PULSE, Shazam, STAR, and Visa.

One of the exhibits included in this report:

- Understanding of single- and dual-message transactions

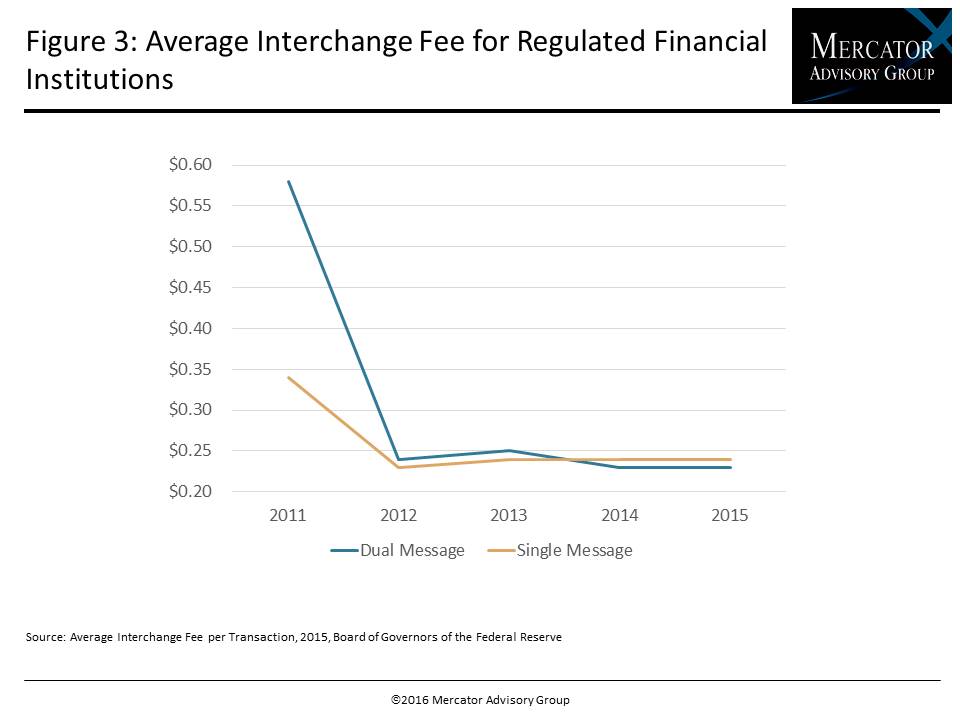

- Review of how interchange is evolving between the EFT and global debit networks

- Markets that the EFT debit networks will pursue with their new services

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world