Overview

In a new research note titled A Deep Dive into Chase Pay, Mercator Advisory Group analyzes the probable structure and workings of the new payments solution and considers its likely prospects among consumers and merchants and its likely impact on the payments industry.

“Clearly Chase has decided that ChaseNet is a success and has doubled down by announcing Chase Pay, which adds a mobile wallet to its alternative payment network that implements a collapsed interchange model and promises to better align with merchant needs. Chase Pay has already partnered with the MCX consortium,” comments,” said Tim Sloane, VP, Payments Innovation, and author of research note.

This research note is 17 pages long and contains 4 exhibits.|

Companies mentioned in this document include: Apple, Google, JPMorgan Chase, PayPal, Samsung, Starbucks, and Visa as well as 18 technology vendors identified by Chase as partners in Chase Pay.

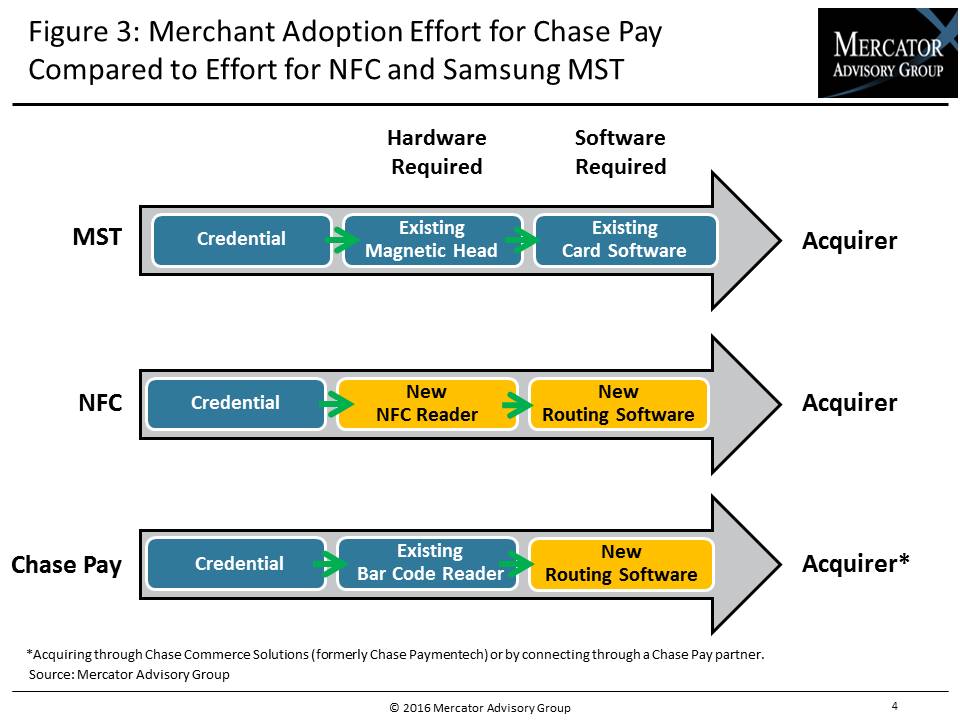

One of the exhibits included in this report:

- Description of the probable components of the solution

- Analysis of benefits to merchants

- Routing and regulatory considerations

- MCX wildcard

- Potential effects on merchants acquirers’

- Profiles of 18 technology vendors designated by Chase as “helping merchants to accept Chase Pay”

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world