Overview

Boston, MA

August 2006

Declining Credit Card Growth: A Glass Half Full

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

This report explores the topic of declining growth rates in credit card outstandings and payment volume. Conventional wisdom suggests the golden age of credit card growth is over in the United States, while at the same time, debit card volumes are growing at rates not seen on credit cards for a decade and are poised to overtake credit.

As this report will illustrate, there are plenty of reasons why the credit card industry is rapidly changing. Credit card issuers need to be cognizant of these multiple influences as they set their strategies, as they are fighting a marketing battle on multiple fronts. Simply stating that growth is slowing or that the market is maturing grossly over-simplifies the credit card issuing environment. Indeed, given the confluence of significant competitive and economic events, it is perhaps remarkable that the news for issuers is not worse. Indeed, a wide array of opportunities exist for credit card issuers wishing to take on the market's challenges.

While declining credit card growth is a fact, it is impossible to pin the trend on a single cause. The report identifies eleven market-related conditions that contribute to slowing credit card growth, including product, consumer behavior, and macroeconomic influences. Some changes can be viewed as primarily evolutionary in nature (e.g. debit substitution) and moving primarily in one direction, while others may be cyclical and tied to the broader economic environment (e.g. changing rate environment). In addition to reviewing market factors driving today's credit card marketplace, the report reviews a number of strategic tools that may be used by credit card issuers to revitalize their growth in originating new accounts and building volume with existing accounts.

Ken Paterson, Director of the Credit Advisory Service at Mercator Advisory Group and the author of this report indicates that; "As a long-time leading payment product, the credit card industry has perhaps had the luxury of not needing to worry about changing consumer behavior or the fact that as a mature product, new products might siphon off significant volume. Economic cycles, not always pleasant to handle, have nonetheless been weathered in the past. Today, there is simply more to worry about."

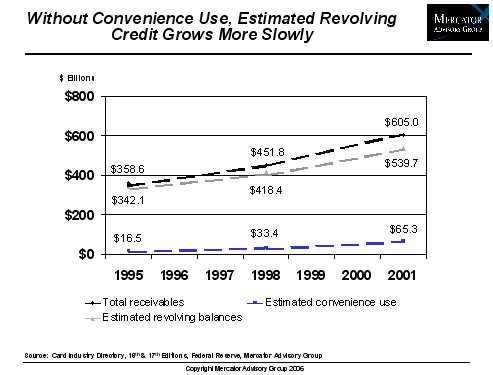

One of the 20 Exhibits in this report

The report is 35 pages long and contains 20 exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

2026 Credit Card Risk: Happy Days are Here Again (For Top Issuers)

The year bodes well as 2026 approaches the end of the first quarter. Economic indicators are strong, the credit card market is growing at a healthy rate, and credit cards rem...

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Make informed decisions in a digital financial world