Overview

Boston, MA

April 2007

Debit Rewards At the Top Fifty Banks

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

This report evaluates the changes that have occurred in the Debit Reward marketplace in the last year by comparing the state of the debit reward programs at the top fifty debit card issuers (in annual card holder spending) today as compared to more than a year ago.

Since Mercator Advisory Group last evaluated the debit rewards program operated by the top fifty financial institutions, sixty-six new or modified debit reward programs have been introduced and eleven financial institutions have launched their first debit reward programs. As a result of this much wider adoption of debit reward programs, thirty-two of the top fifty institutions (64%) now have one or more debit reward programs, up from 40% last year. Also important to note is that there are now eighteen banks operating multiple debit reward programs, up from just seven last year. These financial institutions clearly believe the initial investment paid off and are now expanding their programs.

Tim Sloane, Director of the Debit Service for Mercator Advisory Group, and the author of this report indicates that these top fifty institutions represent a significant trend.

"These top fifty institutions account for 67% of all signature debit card spending on MasterCard and Visa. Given the current deployment of debit reward programs 60% of all signature debit spending could participate in a debit reward program. While debit reward programs are rapidly showing up at more and more institutions, new debit reward programs are changing the landscape in a big way. Programs that leverage merchant participation continue to gain traction and there remains significant opportunity for innovation within these programs. I fully expect existing debit reward programs will continue to be deployed by financial institutions even as new reward programs evolve. In the future, newer programs are likely to have an even greater emphasis on efficiency, being structured to drive enhanced retention at declining costs to the institution."

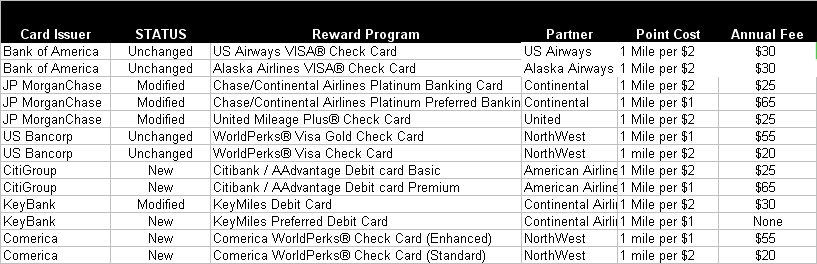

One of the 12 Exhibits in this report:

Mileage Based Reward Programs at Selected Institutions

This report is 27 pages long and contains 12 exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information, please call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world