Overview

Mercator Advisory Group released a new report titled Debit Card Trends in the Asia-Pacific Region and finds that debit card use in the region is far from monolithic. Countries such as Australia and Japan have some similarities to the North American debit market, with a high degree of financial inclusion and a long history of card use. In contrast, countries such as China, India and Indonesia have relied primarily on cash until very recently.

”We find some interesting trends in debit card adoption in each country. Those nations that have been primarily cash based societies are moving towards mobile based solutions supported by QR codes at the point of sale at an incredible pace. This approach also supports another trend; the preference for local networks with technology and data that never leave the country,” comments Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group and author of the report.

This report has 17 pages and 7 exhibits.

Companies mentioned in this report include: China Union Pay, eftpos, Facebook, Google, JCB, Mastercard, National Payment Corporation of India, NetsUnion Clearing Corporation, Peoples Bank of China, RuPay, Visa, Walmart.

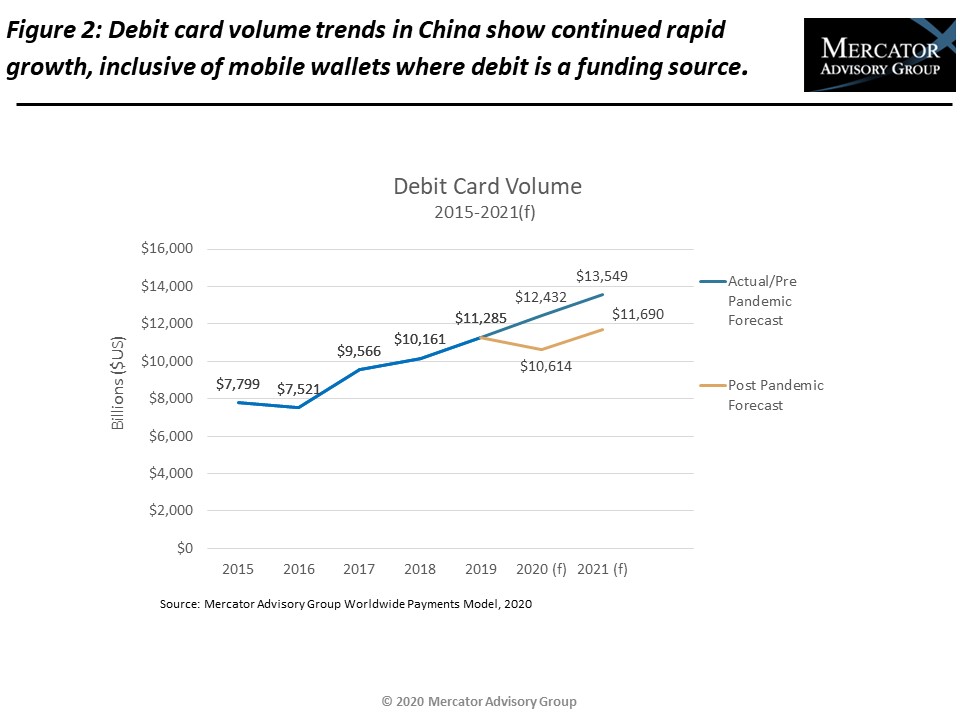

One of the exhibits included in this report:

Highlights of the report include:

- Analysis of the most influential trends in the debit card market in Australia, China, India, Indonesia, Japan, Korea, and Singapore.

- A review for each country of account ownership, the number of debit cards issued, 2019 transaction levels and value processed expressed in U.S. dollars for comparison purposes.

- Transaction volumes processed by country from 2015 through 2019, with pre-and post- pandemic forecasts for 2020-2021.

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world