Overview

Effective Instant Issuance Providers

Instant issuance of debit cards gives financial institutions a competitive edge over fintechs and non-bank issuers by delivering the speed, convenience, and trust that customers expect. Top instant issuance providers offer robust product features, integrable technology, and complementary card printing services, supported by strong customer support and compliance with EMV standards. Providing new or replacement cards on the spot minimizes disruption and reinforces customer satisfaction and loyalty.

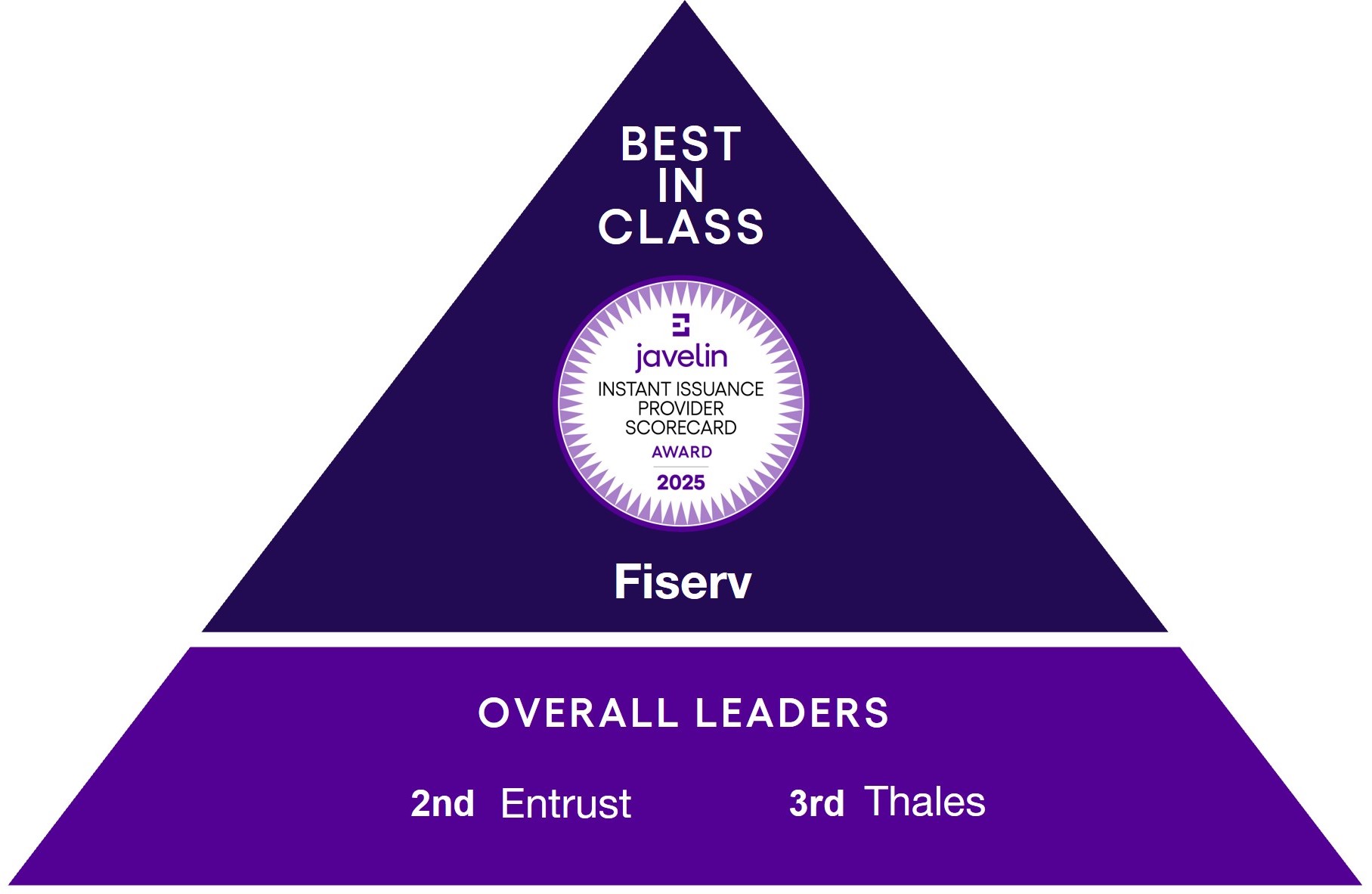

The 2025 Instant Issuance Provider Scorecard evaluates eight instant issuance providers— Alviere, B4B Payments, CPI Card Group, Entrust, FIS, Fiserv, Galileo, and Thales—based on 28 criteria across product features, technology delivery, customer support, and other essential capabilities. While most providers offer essential capabilities, top instant issuance providers stand apart by delivering greater flexibility, seamless integration, and scalable pricing models that support a wide range of institutions.

What You’ll Learn About Instant Issuance Providers

- Why instant issuance is essential for debit card issuers and how it enables seamless, real-time access to new and replacement cards.

- The leading providers of instant issuance services and how they compare.

- The key features that define a best-in-class instant issuance product and their impact on adoption.

Preview Of Key Findings and Javelin Recommendations

The 2025 Instant Issuance Provider Scorecard dives into the key factors that banks, credit unions, and debit card issuers must assess when selecting an instant issuance provider. We recommended that you partner with an innovative vendor that allows you to speed past the competition. By adding these capabilities, you set higher customer expectations for your brand by delivering instant purchasing power to customers that boosts customer satisfaction. Additionally. Instant issuance enables financial institutions to significantly improve the customer experience with greater efficiency and uninterrupted card access, drive card activation and usage rates, and ensure top-of-wallet position, among other benefits.

Companies Mentioned:

Alviere, American Express, B4B Payments, CashApp, Chime, CPI Card Group, Dave, Discover, EMV, Entrust, FIS, Fiserv, Galileo, NCR, PayPal, SoFi, Thales, Venmo, Visa

×

Book a Meeting with the Author

Related content

State of Debit 2026

Despite headwinds that include significant financial strain on consumers despite a broadly stable economy, debit remains resilient—especially among younger consumers and lower inco...

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Make informed decisions in a digital financial world