Credit Cards in a Post COVID World: Seven Takeaways for the Next Business Cycle

- Date:August 10, 2020

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

The good thing about recessions is that they will end and move into the next economic cycle, which economists often call “the trough.” The bad news is that no one knows when the COVID-19 downturn will level. If we use the Great Recession as an example, the recession will last a year and a half, almost half the time it took to get through the Great Depression of 1929-1933.

In Mercator Advisory Group’s latest research report, Credit Cards in a Post COVID World: Seven Takeaways for the Next Business Cycle, readers will review the learnings that we have now which should go into the business models of credit managers as they start thinking about what credit card businesses will look like when we exit the COVID-19 pandemic.

"COVID-19 made an abrupt appearance, and the credit card industry, which thrives in a healthy economy, must contend with record unemployment, diminished GDP, and a loss in consumer confidence,” comments Brian Riley, Director, Credit Advisory, at Mercator Advisory Group, and the author of the research note. Riley adds that "4Q20 and 1Q21 will likely be unprofitable for many credit card issuers as charge-offs peak."

This document contains 15 pages and 7 exhibits.

Companies mentioned in this research note include: ACI Worldwide, American Express, Bank of America, Capital One, Chase, Citi, Discover, FIS, FICO, Fiserv, Mastercard, TSYS, Visa

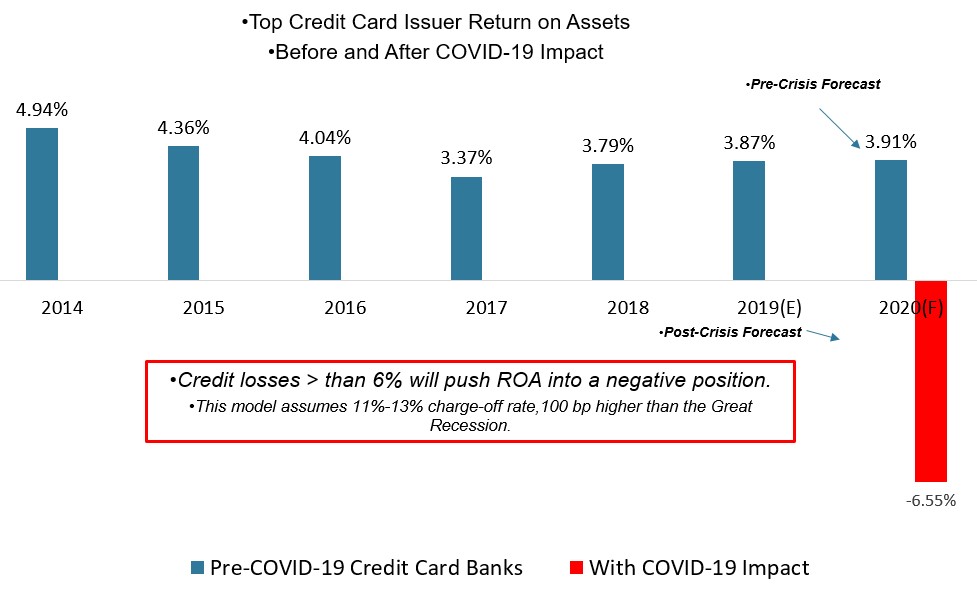

One of the exhibits included in this report:

Highlights of the research note include:

- Once payment deferrals end, expect delinquency aging to skyrocket

- Charge-offs beyond 6.54% will eliminate credit card industry profits

- Credit card return on assets (ROA) will fall into negative territory in late 2020

- Regulatory guardrails helped protect the industry; current expected credit loss (CECL) requirements and contingency planning proved their worth

- Top banks, particularly those required to comply with stress testing and DFAST, were well prepared

- Platform service providers played a significant role in providing options for the middle market.

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world