Co-branded Credit Cards: Reinventing Themselves Post Covid Losses

- Date:August 10, 2021

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

Co-branded Credit Cards: 225 Million Credit Cards Vying for Market Share

Mercator Advisory Group released a report covering the co-branded credit card market, titled Co-branded Credit Cards: Reinventing Themselves Post Covid Losses. The research explains how co-branded credit cards are essential to issuers rebuilding their credit card volume in a post-COVID world.

This report separates co-branded credit cards from private label credit cards (PLCC) because the markets are diverging. Private label credit cards face pressure from Buy Now, Pay Later lenders that do not affect bank-issued credit cards. Co-branded credit cards are vital components of bank-issued branded network credit cards.

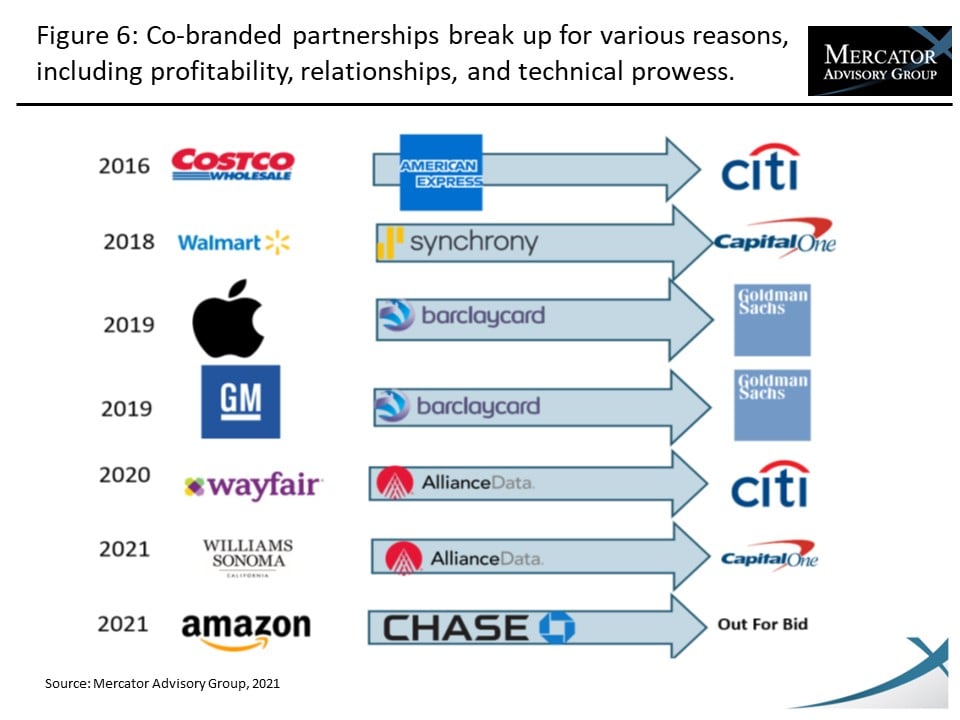

"Issuers must nurture their programs, but they must be careful not to give away the bank,” states Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group. “Sometimes they must be willing to walk away from a deal. Other times, they might need a good-old-fashioned break-up,” Riley continued, “But a well-run program can add scale, increase loyalty in retail customers, and set the pace for cross-selling. Take American Express, Delta Airlines, Citi AAdvantage, or Chase United as examples. And then, there is Costco (Capital One) and Amazon to consider. The shift (and anticipated shift in the case of Amazon) impact both counterparties in the co-branded relationship.”

This document contains 24 pages and 7 exhibits.

Companies mentioned in this document include: AARP, Alliance Data, Alaska Airlines, Allegiant, American Express, American Airlines, Apple, Bank of America, Barclaycard, Capital One, Carnival Cruise lines, Choice Hotels, Chase, Citi, Conde Nast, Costco, Delta Airlines, Discover, Goldman Sachs, GM, Emirates Airline, Frontier Airlines, Hawaiian Airlines, Holland America Cruiselines, Jet Blue, LendingTree, Macy’s, Mastercard, National Football League (NFL), Lufthansa, PayPal, Priceline, PNC, Southwest Airlines, Spirit Airlines, SteinMart, Synchrony, USBank, United Airlines, Visa, Walmart, Wells Fargo, Wayfair, Williams Sonoma, Wyndham Hotels

One of the exhibits included in this report:

Highlights of the research note include:

- Why it makes sense to separate PLCC from co-brands

- Current credit card volumes

- Co-branded market volumes

- The inner workings of a co-branded relationship

- Not every relationship is forever-even in co-branding

- Where the industry is headed

- Strategic plays for credit card issuers

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world