Overview

Mercator Advisory Group’s latest research report, The Canadian Credit Card Market, ties together recent consumer surveys in Canada in Mercator’s North American PaymentsInsights series and draws from Mercator's global payments database to provide a view of the future of Canadian payments.

Readers will see that the Canadian card industry has unique features distinct from U.S. payments. The research report describes six industry-shaping trends that fit the market well and provide a strong foundation for the future.

This research showcases Mercator Advisory Group's recent extension of is surveys beyond the U.S. market as well as Mercator's global payments database. The report draws from survey data in the Canadian edition of Mercator's North American PaymentsInsights, a powerful research asset, which recently expanded into Europe. Readers will also get a glimpse at Mercator's global payments database, which provides analytics for more than 100 countries.

"Canada has a long history of innovation in payments with differences from the United States card market. Innovations include Interac, which was originally a domestic debit payment scheme that ran outside the traditional branded network payment scheme. The nonprofit model converted to a profit-making venture similar to the path Mastercard and Visa took in the early 2000s. The market also has a progressive Code of Conduct that better positions merchants in the payment scheme," comments Brian Riley, Director of the Credit Advisory Service at Mercator Advisory Group and the author of the research report. He adds that "nontraditional lenders and technology play an important role in Canada.”

This document contains 14 pages and 4 exhibits.

Companies mentioned in this research report include: Alberta Treasury Branches, Bank of Montreal, Caisses Populaires Desjardins, Canadian Imperial Bank of Commerce (CIBC), Canadian Tire Bank, Capital One, Chase Cards Canada, Citizens Bank, Credit Union Electronic Transaction Services, Home Trust, Interac, Laurentian Bank, Mastercard, MBNA Canada, National Bank of Canada, President’s Choice Financial, Royal Bank of Canada, Scotiabank, Toronto Dominion Bank (TD) , and Vancouver City Savings Credit Union, and Visa.

One of the exhibits included in this report:

- Number of cards in circulation and number of active accounts in Canada

- Canadian credit card transaction volume

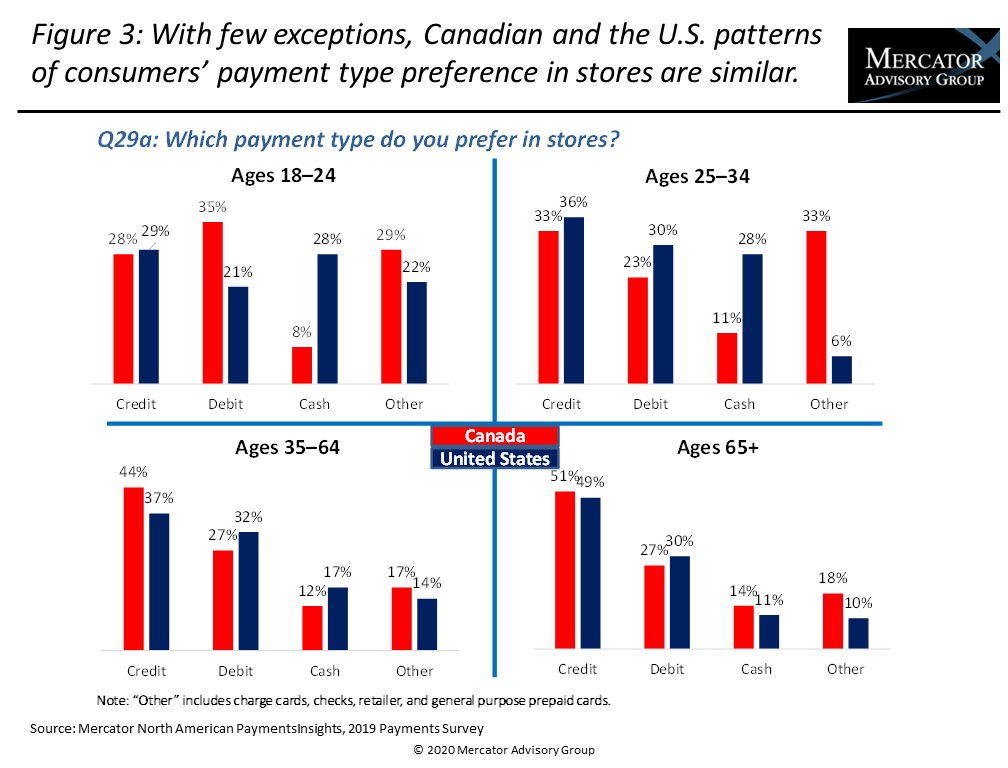

- Canadian consumers’ credit preferences by age cohort

- Requirements of the Code of Conduct for the Credit and Debit Card Industry in Canada

- A discussion of of the uneven success of U.S. card issuers in Canada

- Canada’s strategies for voluntary reduction of interchange

- Ontario’s push to increase minimum-due payments.

Book a Meeting with the Author

Related content

2026 Credit Card Risk: Happy Days are Here Again (For Top Issuers)

The year bodes well as 2026 approaches the end of the first quarter. Economic indicators are strong, the credit card market is growing at a healthy rate, and credit cards rem...

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Make informed decisions in a digital financial world