Overview

Boston, MA

August 2004

Business Process Outsourcing in Financial Institutions Enters a New Phase

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

All banks utilize Business Process Outsourcing (BPO) to some degree. Tier one banks have been methodically adopting outsourcing across multiple departments which has helped them develop significant expertise -- expertise that is sometimes recognized as a corporate resource that can be called in to help new BPO initiatives. Tier two banks have implemented significant outsourcing efforts but are less likely to be expanding their BPO efforts, even though the payoff can be larger for them.

The use of outsourcing to reduce operational costs will rapidly become a capability that differentiates successful tier one and two financial institutions. These organizations will be capable of outsourcing a business process more quickly, more efficiently, and more frequently than competitors -- enabling the institution to more effectively lower costs and more quickly introduce best of breed solutions.

Tim Sloane, Director of the Debit Service for the Mercator Advisory Group and author of the report identifies several challenges financial institutions must address:

"An outsourced process creates a discontinuity that prevents current business applications, management tools and measurement systems to operate transparently. Resolving this discontinuity takes significant integration effort and makes it difficult to measure and monitor the outsourced process. The difficulty in monitoring the outsourced process, coupled with communications hurdles, increases the time it takes to respond when process performance drifts."

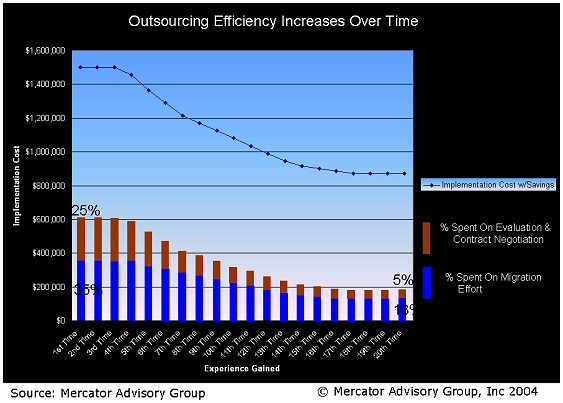

The report "Business Process Outsourcing in Financial Institutions Enters A New Phase" identifies how successful Tier 1 and Tier 2 financial institutions are turning the outsourcing process itself into a core competency. These firms develop a common way to document processes and engage BPO service providers, while also building IT infrastructure that supports rapid and multiple BPO implementations. By establishing a team that integrates finance, IT, and operational units, financial institutions can reduce the costs associated with outsourcing by almost 50%. This reduction is possible by streamlining how business processes are documented and cost justified as an outsourced opportunity, through the development of appropriate financial tools that reduce the cost of pricing and contract negotiations, and by reducing costs associated with migrating applications to the remote location, including systems, software and process knowledge.

Financial institutions that make the process of outsourcing more efficient and cost effective are at a competitive advantage because they can outsource smaller business processes that are typically more costly to operate. Small operations are often the most expensive to operate because they can't operate near full capacity or because the process requires specialized knowldge not specific to the financial domain.

The report is 25 pages and contains 5 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com

For more information call Mercator Advisory Group's main line: 508-845-5400 or send email to [email protected].

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world