Overview

Boston, MA

July 2007

Business Models and Revenue Streams in Merchant Acquiring: Beyond the Monthly Residual Check

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

This report focuses on the current state of the acquiring market and discusses the market strategy of the industry's most successful players. The merchant side of the payment chain until recently has had the reputation in the greater payments space of being its most overlooked facet, whether by the public, by the business community, by the financial market, by regulators, or even by the powers that be within Payments, the card brands themselves. However, as the bankcard associations make the transition to the public ownership from member bank ownership, and as large-scale security breaches targeting payment information continue to attract public attention, the spotlight has turned on previously obscure territory. As the populace becomes more educated about what takes place behind the scenes after they swipe their cards, or click submit, or "tap and go", the attention of private and public investment, as well as that of government regulators, has been drawn to the general business of payment processing, the services it entails, and the rules that govern it. With institutional attention, the public spotlight grows brighter, more intense, and the business begins to change. The current environment is arriving and coinciding with organic changes already occurring in the merchant acquiring market, making this time in particular quite momentous.

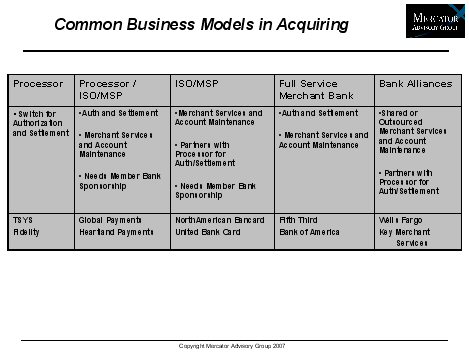

One of the 7 Exhibits included in this report:

The report is 27 pages long and contains 7 exhibits

Report Highlights:

- The merchant side of the payment chain has never before had so much external attention paid to it. Increased attention brings the potential for sweeping change, at a time when changes of an organic nature within the marketplace are already occurring

- The business models of the top players often vary in dramatic ways. Five core models exist, as well as limitless variations and degrees to which certain aspects are emphasized.

- Recent IPO and M&A activity within the broader payments space is having a repercussive impact on the merchant acquiring industry.

- Merchant attrition, the bane of the bankcard acquirer, has taken on new dimensions, and new solutions in the form of value-added services have arisen in attempt to address it and generate fresh revenue streams.

- Two visions of the future of the acquiring market are remarkably clear. In one, the merchant, the consumer, the acquirer, the network, and the issuer all win.

David Fish, Senior Analyst in Mercator Advisory Group's Credit Advisory Service and principal analyst on the report comments, "The tenor of the times in the merchant acquiring space can often be discerned by examining the ways in which acquirers approach the feet on the street. Recruitment of Merchant Level Salespeople or sub-ISOs has generally employed slick marketing that plays on the sales reps' baser desires to "get rich quick", or a gimmicky twist on the value-added programs designed more to entice merchants into quick deals, such as "free" equipment or merchant finance, than truly meet their business needs. These are the symptoms of an industry desperate for something new, something beyond competition based primarily on price. Admittedly, the above tactics are creative ways of attempting a fresh revenue stream for the acquirer, and offer at least the perception of added value to the merchant."

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information, please call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

2026 Credit Card Risk: Happy Days are Here Again (For Top Issuers)

The year bodes well as 2026 approaches the end of the first quarter. Economic indicators are strong, the credit card market is growing at a healthy rate, and credit cards rem...

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Make informed decisions in a digital financial world