Overview

Boston, MA

November 2008

ATMs: The Bank Brand Sitting in the Footprint of a Microwave

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

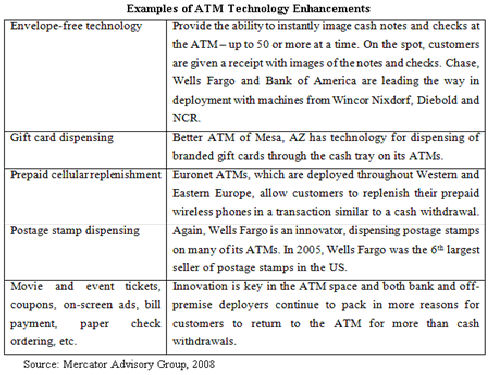

This newest report from Mercator Advisory Group's Retail Banking Practice is focused on the ATM and the multifaceted role it plays in the retail banking market. While ATMs are no larger in footprint than a microwave, they are a strong tool for keeping customers connected to their money, and more importantly, to their bank. Automated teller machines in service today far outnumber traditional bank branches, and so can extend the bank's brand well beyond its expensive bank branch system. Technology enhancements, footprint deployment saturation, surcharges/surcharge-free networks and transaction channel optimization are keys to banks leveraging their current and future installed base of ATMs.

Banks have long been committed to the ATM, growing the number of installed units steadily. But in recent years they have experienced competition from alternate channels - whether from potentially cannibalizing technology such as online banking or the rapid growth of the credit unions' surcharge free networks. In order to allay these competitive forces, there has been a surge in deployment of more technologically-advanced ATMs.

One of the 9 Exhibits included in this report.

Report Highlights:

- With more than four times the number of ATMs than bank branches in the U.S., an ATM is both a billboard for the bank as well as an anchor to the customer's relationship with their financial institution. With 2 million ATMs worldwide, the ATM has the potential to be the ultimate customer-facing technology and brand messenger.

- Fee surcharges for using other banks'/nonbanks' ATMs are just one barrier banks erect to drive their customers' loyal use of their own ATMs.

- As millions of bank customers involuntarily find themselves (post-merger or post failure) with new banks, the ATM provides the perfect platform for banks to introduce themselves to their new customers. Providing leading edge machines with enhanced services in convenient, surcharge-free locations might be the ultimate introduction.

- Mercator Advisory Group research has found that ATMs featuring technology capable of imaging bank notes and checks - a basic function of envelope free - can reduce costs a breathtaking $1 per transaction.

Elizabeth Rowe, Group Director of Mercator Advisory Group's Banking Advisory Services and author of this report, comments, "The convergence of a number of forces is affecting the current ATM market landscape. Competition, emerging technologies, a vastly and rapidly altered retail bank network affected by the subprime market and recent mergers and acquisitions are key factors in how banks will manage and deploy current and future ATM networks. Mix in consumers' constantly evolving payment preferences, and this is just about the most significant time in the history of ATMs."

"A lot is riding on the ATM, much more than fee income derived from transactions. Banks leveraging off-premise ATMs are essentially extending their brand beyond the branch. Fulfilling consumers' demand for enhancements such as envelope-free deposits could turn the ATM into a customer acquisition tool. This is indeed an exciting time for the entire ATM supply chain, from manufacturer to consumer:

The report is 25 pages long and contains 9 exhibits

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world