Asset-Backed Securities: A Primer for Credit Card Managers

- Date:February 25, 2019

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

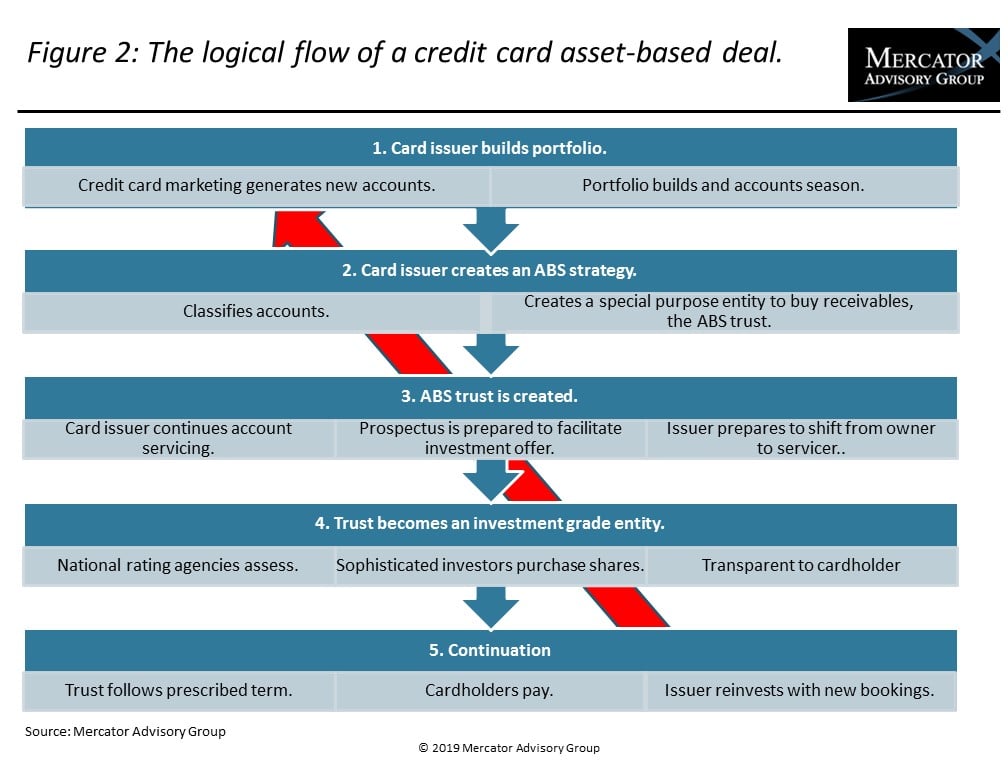

Readers will learn about the logical and legal flows of credit card asset-backed securities (ABS), an important financing tool used by many top issuers. Asset-backed securitization enables lenders to originate credit card accounts, season their portfolios, and then sell the receivables to bank-owned trusts that enable investors to buy future revenue streams. Credit card issuers can generate servicing fees and then use the funds to reinvest in new accounts. One top-tier bank has 50 percent of its portfolio securitized, which is a key component of its growth strategy.

“The report presents a case study of the asset-backed securitization of a credit card portfolio of a major global bank to illustrate the level of analytics covered in an ABS prospectus. One important facet that is apparent is the importance of the FICO® Score and the way it is used throughout the credit cycle from origination to credit cycle management and ultimately through securitization,” notes the author of the report, Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group. He adds: “Dodd-Frank brought discipline to the ABS process, and issuers have a requirement to effectively manage their portfolios, particularly as they place blocks of accounts into the capital markets.”

This document contains 29 pages and 17 exhibits.

Companies and other organizations mentioned in this research report include: Alliance Data Services, A.M. Best, American Express, Bank of America, Barclays Bank of Delaware, Barclays Capital, Capital One, Chase, Citi, DBRS, Discover, FICO, Fitch, KBRA, Mastercard, Moody’s, Morningstar, Scotiabank, Securities and Exchange Commission, Sperry Corporation, Standard & Poor’s, Synchrony, TD Securities, US Bank, and Wells Fargo Securities.

One of the exhibits included in this report:

- Asset-backed securitization volumes by issuing bank since the Great Recession

- Forecasted market projections through 2023

- A view of asset-backed security pricing strategies

- An explanation of how funds disperse based on revenue streams|

- A review of the credit rating process

- How credit managers play an important role in the success of ABS

- A case study drawn from a major global bank that illustrates the seven key elements of an ABS prospectus

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world