Overview

Boston, MA

April 2004

ACH Challenges Cards in New Markets

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

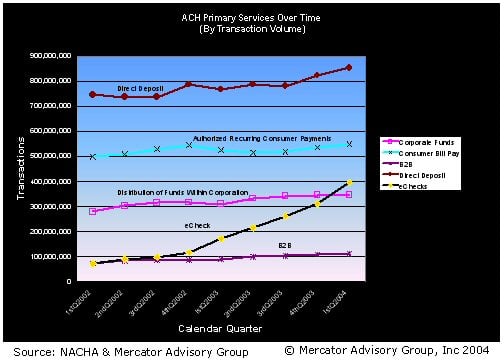

The ACH is entrenched in large corporations. Businesses conducted 1.7 billion ACH transactions in 2003, disbursing roughly $19.7 trillion -- 71.7% of all ACH dollars. These business transactions were for payments among trading partners, payroll, intra-company cash management transfers, government vendor payments, and business-to-government tax withholdings. Card companies, to executre against their strategic growth plans that target corporate accounts, must determine how they will displace ACH. At the same time, ACH has achieved its highest growth rates from inroads into consumer payments, a market where cards are entrenched. The ACH eCheck initiatives, as a group, grew 27.3% in a single quarter (vs. Q4 2003) and by 132.1% annually (Q1 2003 vs. Q1 2004) -- albeit not without significant growth pains.

The ACH growth into non-recurring, low-value, consumer payment markets has worried consumer advocates, and even the Fed because of a potential for fraud and a lack of consumer account protection. These concerns are not likely to slow ACH growth in these markets, however, because growth is driven by merchant adoption -- when high volume, high value transactions are involved, merchants can save significantly by switching consumers to ACH.

Tim Sloane, Director for the Debit Advisory Service for Mercator Advisory Group and author of the report sees a growing issues for many banks and merchants;

"The ACH is a fundamental banking tool for recurring payments and government services, but the rapid growth in consumer payment usage beging driven by merchant adoption puts consumer banks in an awkward position. Banks know that these customers are engaging in relatively risky and unprotected payment practices, but are bound by ACH regulations to accept these transactions."

"On the merchant side, the cost savings derived from the lower transaction costs can be eroded by the cost associated with consumer complaints. Signficantly more ACH transactions are rejected than is common with a bank card and unlike a bank card where the bank will help the consumer and merchant address disputes, ACH rejections are handled by the merchant or the merchant's processor. This research indicates that customer satisfaction is not the first order of business for processors receiving returns, collecting the payment is. Merchants not aware of this high return rates and aggressive collections mentality risk losing their best customers if the ACH solution is not properly implemented."

The report "ACH Challenges Cards in New Markets" looks at ACH strengths and weaknesses and identifies the impact of these on the participants that include consumers merchants, 3rd party processors, originating depository financial insititution (ODFI), receiving depository financial institution (RDFI), and service providers that offer solutions that mitigate ACH risk.

The report is 25 pages and 8 exhibits.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com

For more information call Mercator Advisory Group's main line: 508-845-5400 or send email to [email protected].

Book a Meeting with the Author

Related content

State of Debit 2026

Despite headwinds that include significant financial strain on consumers despite a broadly stable economy, debit remains resilient—especially among younger consumers and lower inco...

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Make informed decisions in a digital financial world