Overview

Boston, MA

June 2005

Account Life Cycle Solutions: Scoring Solutions in Collections and Recovery Workflow Software

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

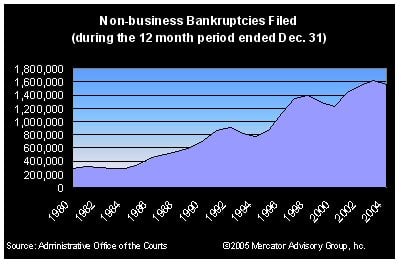

Collections have become an increasingly important area for credit card issuers as the U.S. credit card marekt has matured. The industry faces a number of challenges including intense competition, increased indebtedness and insolvency, and regulatory pressures. Delinquency and defaults are the largest expense for issuers, and the area that offers the most promise for bottom line improvements.

Faced with these challenges, lenders need to find ways to improve the efficiency and effectiveness of collectors. This means processing more deliquent or charged-off acounts with available resources and collecting more in compliance with the regulations.

Evren Bayri, a Director in Mercator Advisory Group's Credit Advisory Service and author of the report comments, "The latest generation of collections and recovery software addresses these challenges by providing improved automation, better analytics, and tighter integration between issuers and their third-parties."

This report takes a look at some of the major vendors and their solutions in the recovery software space. It provides an analysis of the current trends in the U.S. collections industry, looks at the trends in collection technologies and solutions, and covers specific solutions available from CGI-AMS, Fair Isaac, and TSYS.

The report contains 23 pages and 8 Exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

2026 Credit Card Risk: Happy Days are Here Again (For Top Issuers)

The year bodes well as 2026 approaches the end of the first quarter. Economic indicators are strong, the credit card market is growing at a healthy rate, and credit cards rem...

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Make informed decisions in a digital financial world