Overview

Debit card activity in the United States was very brisk in 2019, posting strong growth, but the future growth of debit cards and how they will be used will change materially as the economy is altered by the impacts of the global novel coronavirus pandemic. Mercator Advisory Group’s latest research report, 2020 Annual U.S. Debit Card Market Data Review, presents data on how the market was progressing and what the future may hold for debit card issuers and cardholders.

“Use of debit cards now and in the near term will be slowed the most by historically high unemployment, which affects typical debit card users, who make less than $75,000 annually on average, and by the closure of all but essential retailers. Offsetting this is the trend seen in the past of consumers favoring debit during recessionary periods,” commented Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group, author of the report.

This research report is 16 pages long and has 9 exhibits.

Companies mentioned in this report include: Amazon, Mastercard, and Visa.

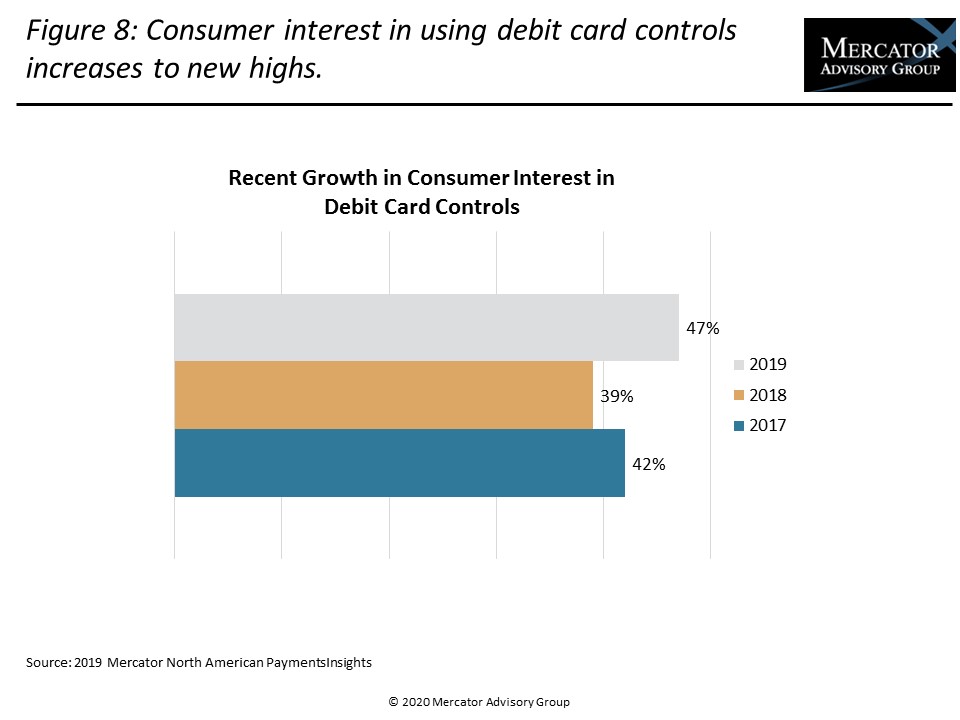

One of the exhibits included in this report:

Highlights of the report include:

- Review of debit card transaction and dollar volume growth trends in past years.

- Forecasts of debit growth through 2022 in light of a brisk “U”-shaped recovery or an extended recessionary period.

- Discussion of how the pandemic has is jolting and shaking loose old payment habits and is likely to be positive for the use of debit in remote channels and create interest in contactless payments.

- The role that ATMs have played during the pandemic.

- Suggestions for what issuers can do to help debit cardholders now, including options for instant issue, promotion of digital support apps like card controls, and altering debit rewards to be most relevant to current needs.

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world