The 2019 Credit Card Data Book: Key Indicators of a Slowing Market

- Date:January 30, 2019

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

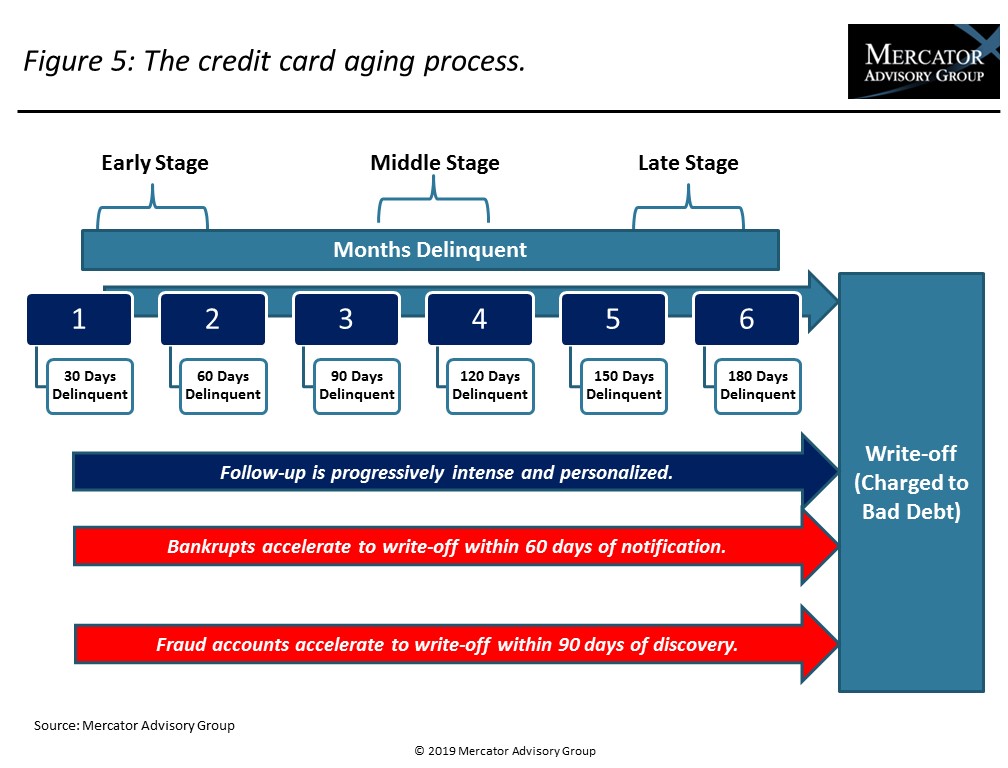

Readers will get a deeper understanding of credit risk in this year’s report along with a detailed explanation of how the credit card delinquency process works. Early and late delinquencies have a direct impact on credit card profitability, which is expressed through the return on assets (ROA) metric. In the United States, credit card ROA has been steadily falling from the 4.94% achieved in 2014. In this report, Mercator projects 2.4% ROA for 2020.

“As 2019 begins, card issuers need to be planning for 2020 and should expect slower growth, slimmer profits, and tighter lending,” commented Brian Riley, Director, Credit Advisory Service, at Mercator Advisory Group, the author of the research report. “Pay attention to how top issuers are keeping their portfolios in check, as issuers outside of the top 100 are seeing severe risk. In 2018, top issuers experienced credit losses of 3.81% of their receivables while those outside of the top 100 saw their rates surge to 7.92%. If this persists, some market consolidation is likely,” Riley continued.

This research report contains 24 pages and 16 exhibits.

Companies mentioned in this research report include: Bank of America, Chase, Citi, and FICO.

One of the exhibits included in this report:

- Revolving debt forecasted through 2022

- Projected U.S. household debt through 2021

- Anticipated U.S. credit card account growth through 2022

- New, early, and late delinquency volumes through 2020

- Prime lending rates, new accounts, and disposable household budgets through 2020

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world