Overview

Consumer use of ATMs to get cash, make deposits, and check balances remains strong despite the decline in check writing and new products like apps for digital person-to-person (P2P) payments, payment cards, and mobile wallets that aim to reduce the need for cash. A new research report from Mercator Advisory Group titled 2018 U.S. ATM Benchmark Report explores bank ATM placements in comparison to branch locations, current fraud trends, the launch of various cardless cash access technologies to provide cardless cash access at the ATM, and consumer attitudes toward ATM use.

“We see continued strong use of ATMs by many consumer market segments, including consumers who are also frequent users of online and mobile banking. Given predictions that cash use will begin to decline and in light of the precipitous drop in check use, making long-term investments in ATMs becomes more complex,” comments Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group and author of the report.

This research report has 17 pages and 10 exhibits.

Companies mentioned in this report include: Bank of America, BB&T, BMO Harris, Cardtronics, CO-OP Financial Services, Fifth Third Bancorp, FIS, Fiserv, JP Morgan Chase, KAL ATM Software, Mastercard, Payment Alliance International, Salem Five Bank, Speedway, Visa, and Wells Fargo Bank.

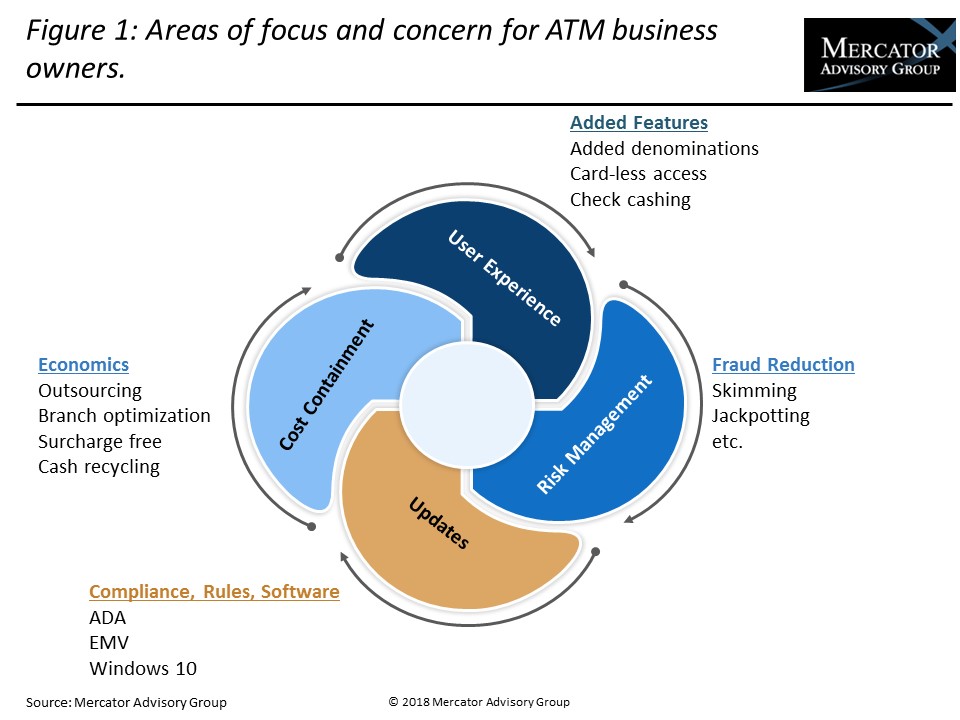

One of the exhibits included in this report:

- Trends regarding ATM fleet sizes of banks in the U.S. relative to the number of branch locations, and the use of co-branded ATMs and surcharge-free networks as a part of a total self-service banking strategy.

- Discussion of U.S. consumers’ use of ATMs in combination with digital solutions and the reliance on convenient, surcharge-free access to ATMs when determining their primary financial institution.

- Survey data revealing U.S. consumers’ interest, or lack of interest, in conducting additional transactions beyond getting cash and making deposits at the ATM.

- A review of the leading approaches to providing cardless cash access through the use of Near Field Communications technology, one-time passcodes or Quick Response (QR) Codes.

- The ongoing struggle ATM owners have to keep their ATM fleets relevant while also keeping costs in line, including thwarting the latest fraud attack methods.

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world