Overview

Driven by growing consumer e-commerce and advances in grocery order fulfillment, U.S. online grocery sales continue to increase to record levels. National and regional grocery chains are making major investments in technology and delivery resources to address this online sales channel. A new research report from Mercator Advisory Group, U.S. Online Grocery Shopping Takes Off but Remains a Challenging Channel assesses current industry challenges and opportunities as well as future considerations and implications for the grocery industry.

“Consumers want convenience and immediacy in their everyday shopping routines. Grocers have been late to the online party, but now they are going all out to support customers that prefer online shopping. But grocery order fulfillment is labor intensive and last-mile delivery is expensive, so the online channel will be financially challenging for grocers.” commented Raymond Pucci, Director, Merchant Services at Mercator Advisory Group, the author of this report.

This report is 14 pages long and has 4 exhibits.

Companies mentioned in this report: Ahold Delhaize, Albertsons, Aldi, Amazon.com, BJ’s Wholesale Club, Costco, Food Lion, FreshDirect, Instacart, Giant, Hannaford, H-E-B, Kroger, Lidl, Market Basket, Peapod, Postmates, Publix, Sam’s Club, Shipt, Smart & Final, Stew Leonard’s, Stop & Shop, Target, Trader Joe’s, Walmart, Wegmans, and Whole Foods.

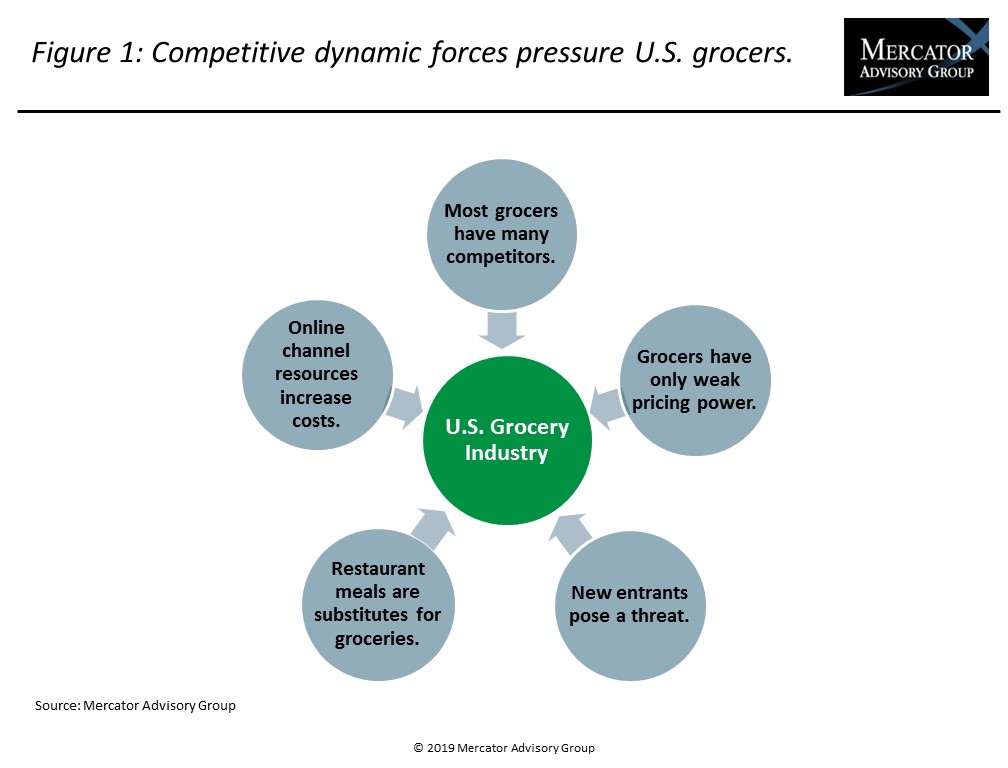

One of the exhibits included in this report:

Highlights of this research report include:

- Competitive industry forces impacting the grocery industry

- How e-commerce has become the virtual grocery aisle

- Supporting role played by third-party delivery companies

- Market share data estimates of leading U.S. online grocers

- Obstacles to consumer adoption of online grocery ordering

Book a Meeting with the Author

Related content

Agentic Commerce: Green Light or Flashing Yellow for Merchants?

Agentic commerce is forecasted to reach $500 billion in sales by 2030, but what’s driving that growth? Consumers will vote with their wallets on which product categories and sales ...

Merchants Should Planogram Payments

Enterprise merchants have increasingly adopted payment orchestration strategies to drive new payment types, increase payment success rates, and optimize platform performance. Howev...

2026 Merchant Payments Trends

As payment technology advances and offers greater options and flexibility for consumers, merchants are put in the position of prioritizing how to manage payment acceptance, what pl...

Make informed decisions in a digital financial world