Overview

The year of COVID-19 has crushed the restaurant and retailing verticals, resulting in thousands of store closings and the loss of millions of jobs. But digital ordering, especially mobile-order-and-pay apps whose orders are typically fulfilled via take-out or delivery, and do not rely on inside dining, have shown initial resilience and subsequent growth. U.S. consumers are pivoting to mobile devices from landline PCs for online shopping, and Mercator data reveal that mobile order app activity has doubled from 2018 to 2020. Restaurants and retailers can significantly benefit from this increased consumer adoption of mobile ordering. A new research report from Mercator Advisory Group, How Mobile Order and Pay Provides a Lifeline for Restaurants and Retailers during Covid-19, sizes up and assesses a major segment of the U.S. mobile- order-and-pay market.

“Mobile-order-and-pay apps have found a sweet spot in the U.S. Quick Service Restaurant (QSR) segment. But other restaurants and retailers can emulate the benefits and success of this buying method that’s become increasingly popular with consumers looking for convenience and immediacy. These mobile apps are well aligned with the restrictions and challenges of COVID-19, and can provide retailers across all verticals a sales channel opportunity during the pandemic and beyond,” commented Raymond Pucci, Director, Merchant Services Practice at Mercator Advisory Group, the author of this report.

This report is 12 pages long and has 6 exhibits.

Companies and other organizations mentioned in this report: Ahold Delhaize, Albertsons, Best Buy, Burger King, CardFree, Chick-fil-A, Chipotle, Costco, Domino’s, Dunkin’, FutureProof Retail, Home Depot, Kroger, Lowe’s, McDonald’s, Panera Bread, Restaurant Brands International, Sam’s Club, Square, Starbucks, Subway, Taco Bell, Target, Tim Hortons, and Walmart.

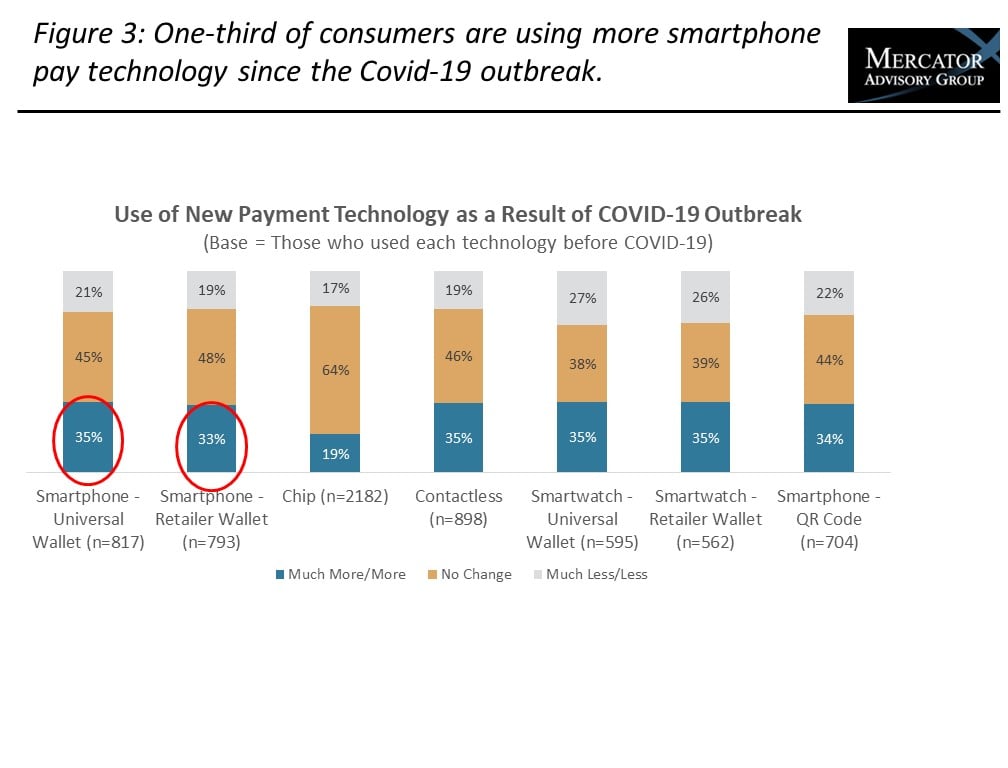

One of the exhibits included in this report:

Highlights of this research report include:

- Consumer behavior patterns for mobile shopping

- Ways for restaurants and retailers to gain sales during COVID-19

- Sizing of the U.S. mobile-order-and-pay market for QSRs

- Common features of successful mobile apps

- Flywheel effect created by digital ordering

Book a Meeting with the Author

Related content

Agentic Commerce: Green Light or Flashing Yellow for Merchants?

Agentic commerce is forecasted to reach $500 billion in sales by 2030, but what’s driving that growth? Consumers will vote with their wallets on which product categories and sales ...

Merchants Should Planogram Payments

Enterprise merchants have increasingly adopted payment orchestration strategies to drive new payment types, increase payment success rates, and optimize platform performance. Howev...

2026 Merchant Payments Trends

As payment technology advances and offers greater options and flexibility for consumers, merchants are put in the position of prioritizing how to manage payment acceptance, what pl...

Make informed decisions in a digital financial world