Overview

Consumers looking for help to manage debt, track their spending, create savings, or make inexpensive stock trades are in luck. The number of apps available to help them manage every aspect of their finances is growing seemingly exponentially. Many of them from financial technology companies, fintechs, that seek to disrupt the traditional banking industry. And many of these apps rely on access to users’ banking data that users prefer to have updated automatically rather than type it in manually. Without mandated security standards like the open banking standards in the European Union, data ownership and the protection of that data are in question.

Fintech and Debit Cards: Battling for Consumers’ Attention, a new research report from Mercator Advisory Group analyzes this new market, reviews a variety of apps budgeting, coupons and rewards, saving, and investing, and offers advice to banks and credit unions on ways to avoid disruption by the fintechs.

“The market for personal financial planning apps has matured in the last couple of years. The quality of the advice and interactions with users has really improved. These apps depend on getting the individual consumers’ banking data, however, and that is raising questions about data ownership and security here in the United States, where open banking hasn’t been codified,” comments Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group, and author of the report.

This research report has 16 pages and 2 exhibits.

Companies mentioned in this report include: Acorns, Albert, Amazon, Apple, Betterment, BMW Bank of North America, Citigroup, Digit, Dosh Every Dollar, Facebook, GasBuddy, Mint, Nelnet, Qapital, Robinhood, Sallie Mae Bank, Simple, SoFi, Square, Stanford Federal Credit Union, Stash, Trim, WEX Bank, and You Need a Budget.

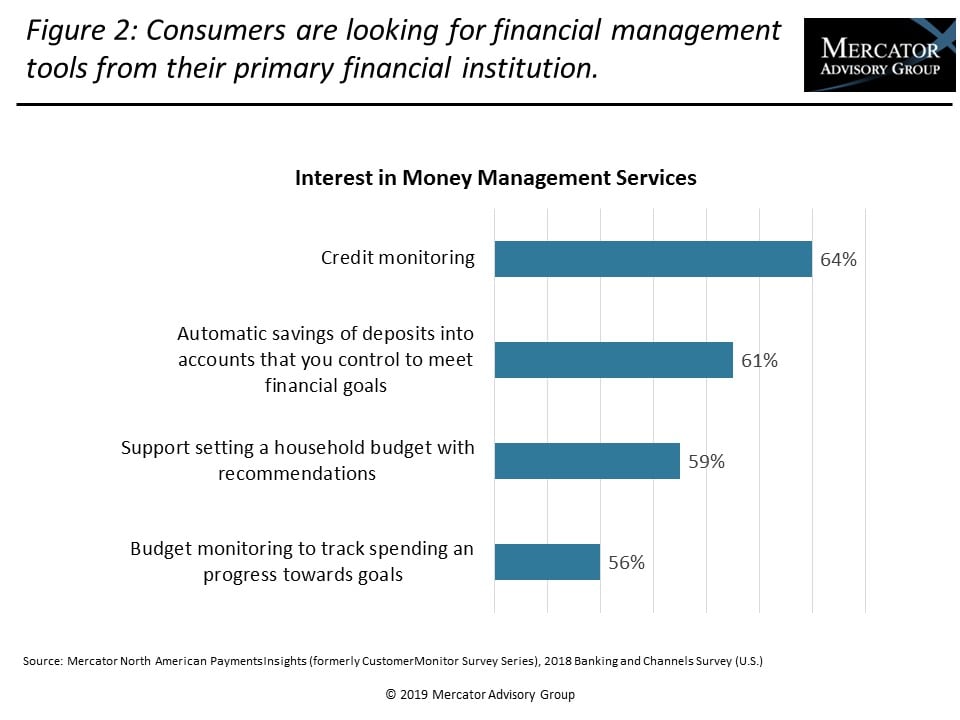

One of the exhibits included in this report:

- Market trends in consumer financial planning apps

- The use of banking data needed to feed the planning apps

- Fintechs’ consideration of banking charters not only to provide financial advice but also to manage the accounts, gather deposits, and issue credit

- A review of 14 apps focused on spend tracking, savings, or investing

- Why banks and credit unions could be better providers of these apps with the right solution

Book a Meeting with the Author

Related content

State of Debit 2026

Despite headwinds that include significant financial strain on consumers despite a broadly stable economy, debit remains resilient—especially among younger consumers and lower inco...

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Make informed decisions in a digital financial world