Overview

Technological Innovation Causes Disruption in Merchant Acquiring: New Trends Emerge

Mercator Advisory Group released a report covering merchant acquiring titled Alternative Acquiring: The Evolution of Merchant Acquiring in the 21st Century. The research explains the current market, discusses the driving factors that influence merchant choices and market shares, and how different stakeholders can gain a foothold in this rapidly evolving ecosystem.

This report explores the breadth of merchant acquiring in the 21st century, utilizing proprietary merchant surveys to analyze the key trends and factors affecting merchant choices for their banking, software, and acquiring needs. Through this analysis, Mercator Advisory Group provides readers with actionable insights on industry developments, expected product trajectories, and ideal pathways towards preparing your business practices to meet the needs of an ever-changing market.

"This is a highly complex and nuanced topic, with a key challenge being that established definitions of acquirer, processor, ISO, and ISV are blending constantly,” comments Don Apgar, Director, Merchant Services at Mercator Advisory Group. Apgar continues: “The industry is rapidly approaching a tipping point, struggling to fit digital commerce into an analog industry constructed decades ago. This is an extension of Mercator’s report on Chargeback and Fraud Service Providers, where a cottage industry of new fintechs have emerged to assist merchants who are operating in a digital world to work within analog rules.”

This document contains 18 pages and 6 exhibits.

Companies mentioned in this research note include: Visa, American Express, Stripe, Square, Payoneer, Skrill, Fiserv, Clover, Toast

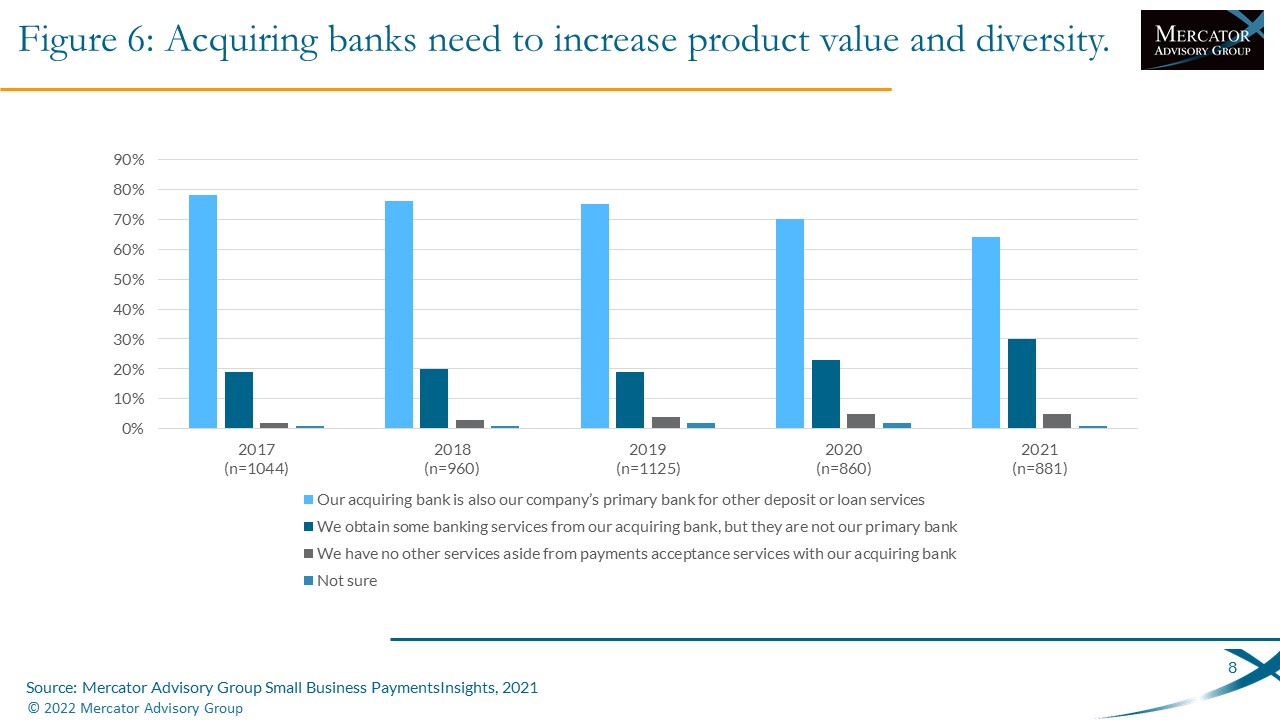

One of the exhibits included in this document:

Alternative Acquiring: The Evolution of Merchant Acquiring in the 21st Century

Highlights of this document include:

- Overview of merchant acquiring in the 21st century

- Definition of traditional and alternative acquiring based on market analysis

- Leading developments and technological innovation

- Merchant survey data that explores the various factors affecting their choice of acquiring partner

- Collaboration and partnership opportunities for current acquirers to keep up with disruptive entities

Book a Meeting with the Author

Related content

Agentic Commerce: Green Light or Flashing Yellow for Merchants?

Agentic commerce is forecasted to reach $500 billion in sales by 2030, but what’s driving that growth? Consumers will vote with their wallets on which product categories and sales ...

Merchants Should Planogram Payments

Enterprise merchants have increasingly adopted payment orchestration strategies to drive new payment types, increase payment success rates, and optimize platform performance. Howev...

2026 Merchant Payments Trends

As payment technology advances and offers greater options and flexibility for consumers, merchants are put in the position of prioritizing how to manage payment acceptance, what pl...

Make informed decisions in a digital financial world