Overview

Research from Mercator Advisory Group titled The Visa Developer Platform: Opening the Gates to Innovation identifies how Visa has opened up its network to the widest possible range of developers by creating a sandbox that all developers are free to play in. This approach is entirely new, and if it succeeds in generating innovation, it will become the model for other networks, acquirers, and perhaps innovative issuers. The research note also provides a nontechnical guide to the services that have been API enabled so businesses can quickly grasp how these application programming interfaces (APIs) can be used in their environment to better engage existing customers and create new business opportunities.

“Visa has turned the payment application development model on its head,” said Tim Sloane, VP, Payments Innovation, at Mercator Advisory Group and author of report. “By making a sandbox available to all developers that safely mimics the Visa network, developers are free to innovate with no investment. In return, Visa and its partners have the opportunity to identify and select the solutions that show the most promise. Obviously payment applications must ultimately be sponsored by an entity that is obligated to protect the network, but the sandbox lets developers show everyone one they can accomplish which should make finding a trusted Visa partner much easier. This approach will have ramifications for issuing banks, merchant banks, merchant acquirers, and ISOs.”

This note is 19 pages long and has 1 exhibit.

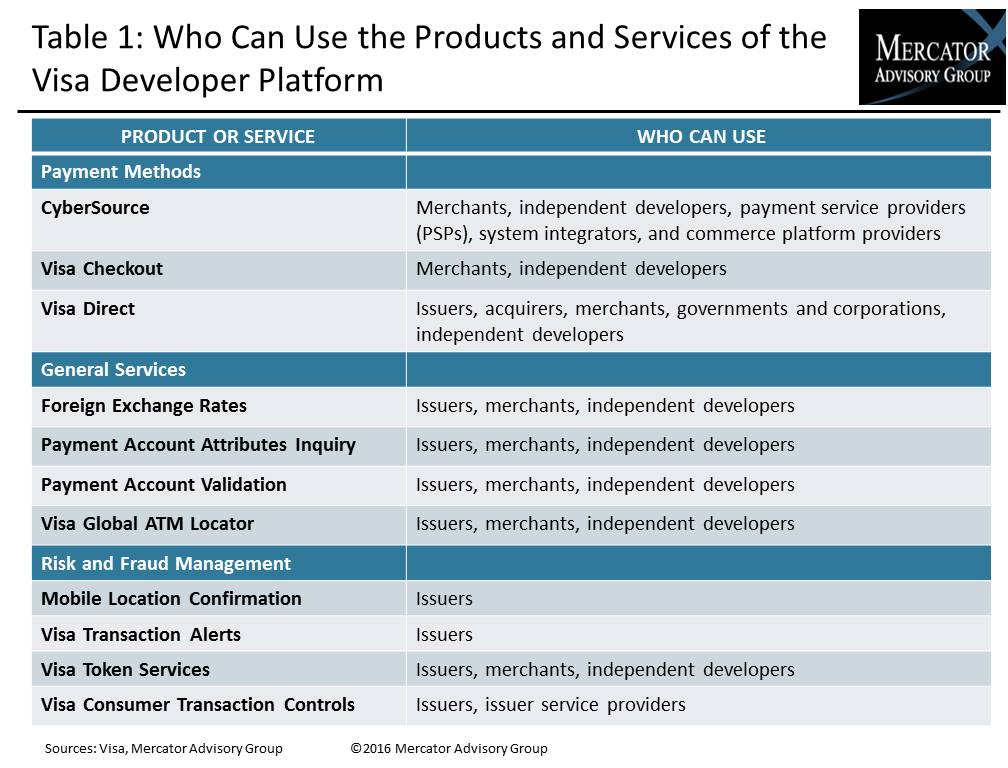

One of the exhibits included in this report:

- Provides the reader a simple guide to the services that Visa has made available to the public

- Provides a reasonable level of detail related to the specific functions each API controls sufficient to enable businesspeople to think through how each API could be incorporated into their respective business processes

- Analyzes the impact of this new approach to finding developers, especially the availability of the sandbox

- Analyzes the potential impact on competitors

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world