Overview

US Person-to-Person Mobile Payments Market:

Gee Whiz or Gee Why?

Boston, MA -- Mobile person-to-person payments is a promising service and a logical expectation for smartphone users accustomed to the "app for that" approach. But today's mobile person-to-person payments fail to deliver on key performance criteria for consumers, especially in the areas of speed to spend, ubiquity and convenience. This new report from Mercator examines the questions "why hasn't mobile P2P taken off" and "what's it going to take to get off the ground."

Revealed in Mercator Advisory Group's US Person-to-Person Mobile Payments Market: Gee Whiz or Gee Why? are essential attributes of a P2P payment system and how five of today's providers stack up against those performance criteria. Offerings from PayPal, Fiserv Zashpay, CashEdge's Popmoney, MasterCard MoneySend and Obopay are discussed as is the entry of new vendors into this emerging market.

"Consumers will consider application-specific mobile P2P payments, for splitting the bar tab for example, or will look for a P2P service from a financial institution, card brand or payment service," George Peabody, Director of Mercator's Emerging Technologies Advisory Service comments. "In all cases, the problem of ubiquity is a huge drag on success. Combine that challenge with the thin margins available and you have a rough road ahead. Looking forward, ubiquitous NFC-equipped smartphones and a centralized service to connect payment services are needed to make mobile P2P commonplace."

This report focuses on the current state of mobile P2P, how transactions are made, and compares the process to good old fashioned cash.

Highlights of the report include:

Mobile person-to-person payments are in their infancy and are unlikely to crawl out of the crib until smartphone and NFC ubiquity is reached.

Smartphone adoption's accelerated growth will fulfill a necessary precondition for mobile P2P payments with three years.The arrival of NFC in 2011 and its swift growth opens up a payment modality for mobile, proximity-based P2P market that closely replicates the passing of cash. Provided interoperable settlement is available, a big barrier, NFC could accelerate mobile P2P.

PayPal leads the way in the ubiquity race with the largest user base and broad support for mobile platforms.In Mercator's review, PayPal scored the highest ranking among current mobile P2P offerings against nine essential solution attributes.

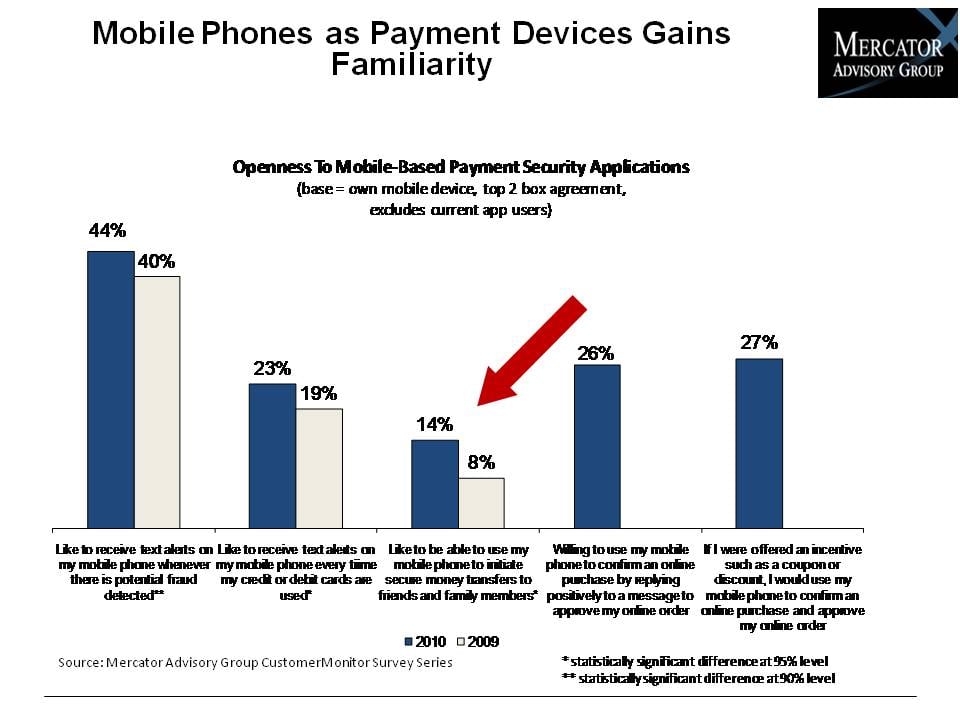

One of the 16 exhibits from the report:

This report contains 31 pages and 16 exhibits.

Companies mentioned in this report include: Fiserv, PayPal, Jack Henry & Associates, Cimbal, MasterCard, Obopay, RIM, Apple, Google, Palm/HP, Microsoft, Citi, eBay, Chase, US Bank, Golden 1 Credit Union, Bank of the West, Visa, Boeing Employee Credit Union, Venmo, Buxter, Boku, Facebook, AMEX, Discover, Bancorp Bank, San Diego County Credit Union, America First Credit Union, the Golden 1 Credit Union, Centra Credit Union, First Hawaiian Bank, PNC Financial Services Group, US Bank, Blackhawk Network.

Members of Mercator Advisory Group have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world