Overview

New Research Examines Developments in the

U.S. Merchant Acquiring Space

The US Merchant Acquiring Market 2009:

Accelerating Change in a Down Economy

Boston, MA - Mercator Advisory Group's annual report on the merchant acquiring industry in the United States is now in its third year. While developments in this market unfold at a surprising pace, the old cliche about "the more things change" has never rung so true. Accelerating change seems to be the new constant.

In our first two years doing the acquiring market overview, we identified and delineated trends in the space that have accelerated and, in some cases, have come to their full fruition. Notable among the topics we've analyzed and discussed in reports, as well as in advisory sessions with our clients, has been growing competition for merchant customers between banks and non-banks (ISOs), and the seeming push on the part of banks to "reintermediate" themselves in the merchant card acceptance value chain in a more significant way. Value-added services and technology continue to play a larger role as the commoditization of payment processing services truly begins to hit home for acquirers. The evolving scope of PCI is also fresh in the minds of our clients and other participants in the space as the industry saw the announcement of two major breaches of payment card information at payment processors over the last year.

Last year's report predicted a perfect storm converging on the acquiring space that would significantly alter the industry landscape. Many of the same issues are still brewing - a still-foundering economy and lingering recession, new laws regulating the payments space, and another round of pending legislation targeting interchange and the cost associated with merchant card acceptance being chief among them. The third key issue that we identified last year, however - dissolution of the largest acquiring operation in the world - has evolved into a new instance of market consolidation with the announcement of a different joint venture between two of the top 3 acquirers in the US market. The space has been ripe for consolidation over the past few years, and the economy and the other market forces we've alluded to have pressed the issue.

As merchant acquiring faces its existential crisis, the question of what it truly means to be a merchant acquirer naturally arises. In this year's report, we update our discussion of the various basic business models used by acquirers and other participants on the merchant side of the payments value chain to go to market in the US, and increasingly in other parts of the world. We also examine updated industry data concerning the market performance of the top players in the space and we make projections about how these players might stack up in the years ahead. Finally, we further explore the impact and potential impact of some of the secular trends within Payments and their effect on the acquiring business in particular, now and in the future.

"The economic downturn was the single biggest determining factor in the various performance records of the nation's largest acquirers in 2008. Merchant attrition and declining volume growth due to reduced consumer spending both had a large impact on merchant acquirers' business," comments David Fish, Senior Analyst in Mercator Advisory Group's Credit Advisory Service and author of the report. "As we consider the merchant acquiring space currently, and where it might be headed, we need to take into account many of the trends and the market events that stand to have a broad impact, either as catalysts or symptoms of these trends. Whether the issues at hand are a root cause of market dynamics or the result of them, change is happening in the space either way. Fortunately, the acquiring side of the payment chain has a long history of fighting tooth and nail for its slice of the action."

Report Highlights Include:

-

Change is the new constant in the US merchant acquiring space, with the pace accelerating as pressure from market forces intensifies.

-

However, the forces impacting the domestic acquiring market remain largely the same. Acquirers have been adapting to the new normal in a variety of ways.

-

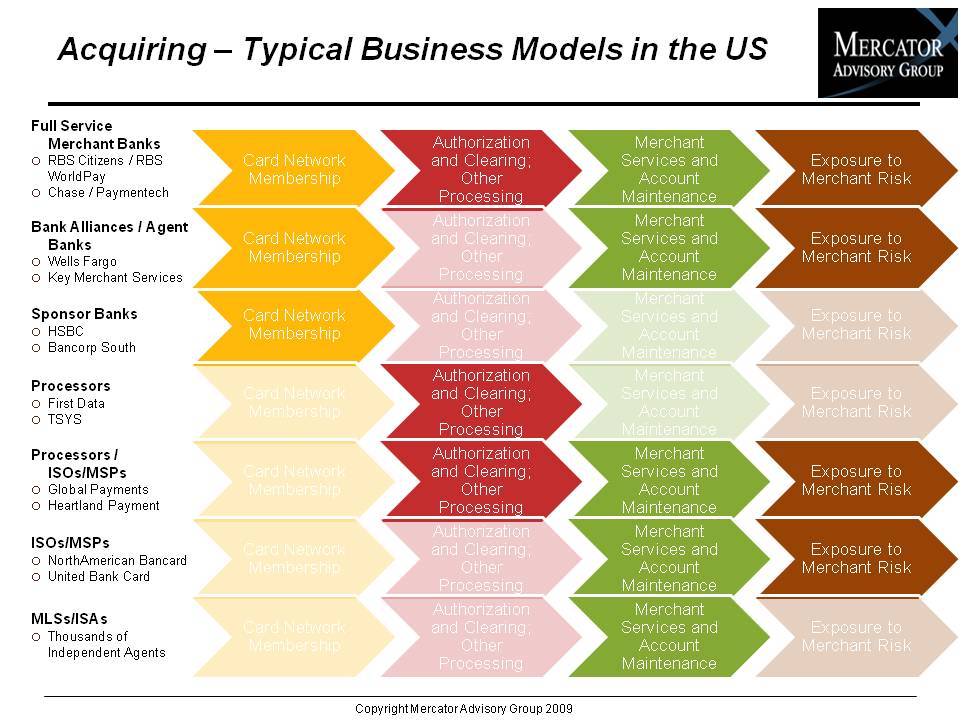

We provide an expanded taxonomy of the 7 basic business models acquirers use to further clarify what it means to be an acquirer.

-

Market data covering the top 10 US acquirers is delineated and analyzed, and our projections for acquired bankcard volume suggest a very different landscape within five years.

-

The market is poised to continue a trend of consolidation, driven by the economy, new complexities arising from data security issues, and increasing competition between banks and non-banks.

One of the 11 Exhibits included in this report:

This report contains 29 pages and 11 exhibits

Companies Mentioned in This Report:

Advent International; Alliance Data; American Express; Banc of America Merchant Services; Chase Paymentech; Citi Merchant Services; Discover; Elavon; Fifth Third Processing; First Data; First National Merchant Solutions; Global Payments (GPN); Heartland Payment Systems (HPY); Intuit Payment Solutions; Kohlberg, Kravis & Roberts (KKR); MasterCard; Moneris; National Processing Corp. (NPC); Network Solutions; RBS WorldPay; SunTrust Merchant Services; TSYS; Visa; Wells Fargo Merchant Services.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Mercator Advisory Group is the leading independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Book a Meeting with the Author

Related content

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Honor All Cards: The U.S. Credit Card Model Takes a Hit

The Honor All Cards principle—that any merchant with a Visa and/or Mastercard sticker in the window accepts all card products on those networks—could be undermined by a recent sett...

Make informed decisions in a digital financial world