U.S. 2022 Person-to-Person (P2P) Payments Market Update

- Date:June 29, 2022

- Author(s):

- Jordan Hirschfield

- Research Topic(s):

- Debit

- PAID CONTENT

Overview

Person-to-Person (P2P) Payments Usage Continues to Grow

Person-to-Person (P2P) payments continue to drive a larger share of consumer-to-consumer payments and to replace check and cash usage as individuals move to higher usage of digital and contactless payment sources. This shift is leading to increased account growth and volume transactions for major P2P players, thus enabling greater extensions of their business into business-to-business (B2B) and business-to-consumer (B2C) applications as well as other financial service tools.

As P2P moves into maturity, there are several methods vendors take to accomplish the main goal of P2P, transferring cash from one party to another through an electronic network in real-time. Depending on the service used, funds are debited from the user’s service account or directly from the user’s bank account and credited to the recipient’s reciprocal account. In the past five years the importance of P2P for consumer use has grown from a nice-to-have, burgeoning service to a must have technology. A new research report from Mercator Advisory Group titled U.S. 2022 Person-to-Person (P2P) Payments Market Update looks at the current state of person-to-person (P2P) payments and the shifts that are occurring.

P2P usage continues to grow and the marketplace for P2P providers has solidified. Providers are more clearly identifying their value proposition and ancillary services to compete not only with each other but also with other payment forms. With that comes an increasing threat of fraud and risk that must be addressed as P2P emerges into a mature state.

"P2P is effectively replacing cash and check payment options and is requiring merchants to uncover methods of acceptance, providers to develop alternative outlets to pay (such as debit and credit cards tied to P2P accounts), and consumers to more readily adopt P2P as a method of financially interacting with businesses," comments Jordan Hirschfield, Research Director at Mercator Advisory Group and author of the report.

This report is 15 pages long and has 7 exhibits.

Companies and other organizations mentioned in this report: Apple, Bank of America, Cash App, Google, PayPal, Payrailz, Payveris, Samsung, Venmo, Wells Fargo, Zelle

One of the exhibits included in this report:

- Current State of P2P

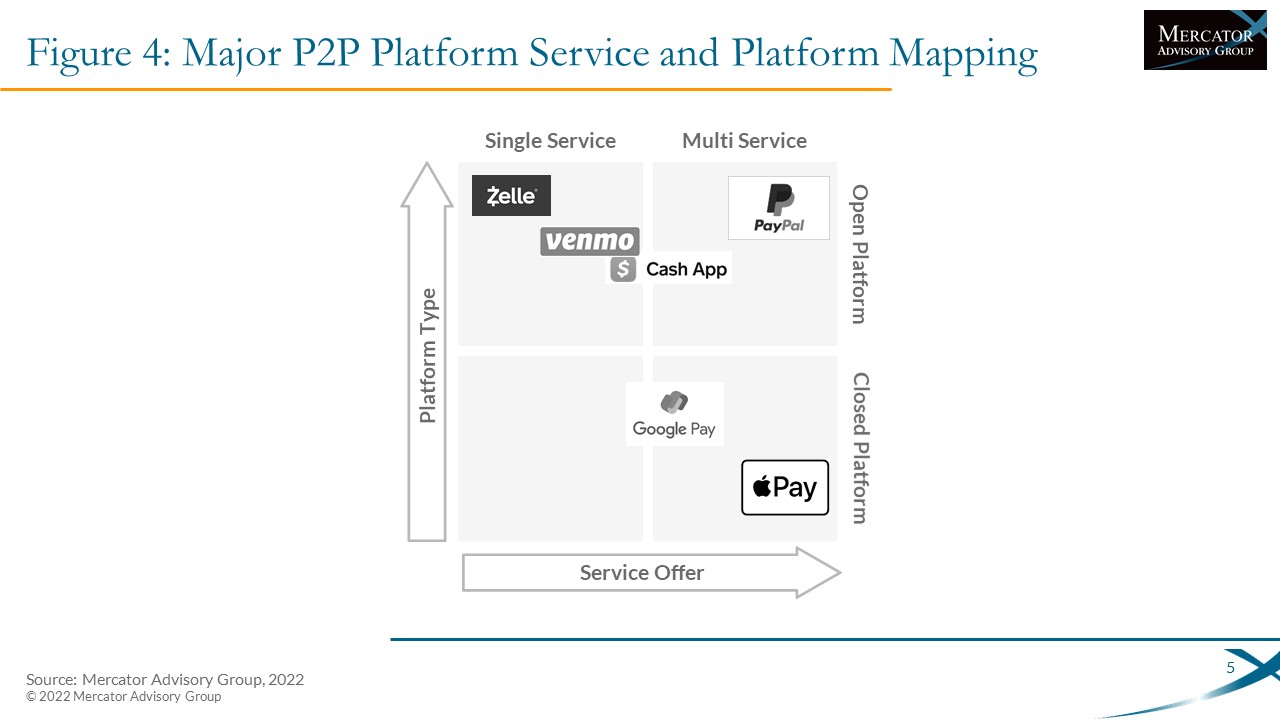

- Solution Segments

- Risks facing P2P payments

Book a Meeting with the Author

Related content

The Target Circle Card Program: If at First You Don’t Succeed, Try Again

Target Circle Card program is a standout loyalty program for offering credit and debit card products. However, the program is under pressure, and there are lessons to be learned. F...

2026 Debit Payments Trends

For decades, the checking account has served as the foundation on which all consumer and business payments have rested. But that stability is now beginning to give way to the seemi...

Shifting the Balance: How Consumers Are Using Bank Accounts Today

Consumer payment habits show an interesting blend of change and resilience. As those habits relate to the use of checking accounts—and even fintech offerings that aren’t really che...

Make informed decisions in a digital financial world